From the archives: the evolution of the cheque

Smartphone-based cheque imaging is just the latest development in the long history of the cheque.

These fascinating images from the Barclays archive show how cheques have evolved from handwritten notes – via mergers, war, automation and even a giant halibut – to a quick-clearing method of payment that can be deposited anytime, anywhere. Defying predictions that it would become obsolete with the introduction of new payment methods, it seems the cheque has adapted rather than died.

The story begins in 13th century Venice, when the cheque was created as a device to allow international trade – without having to physically carry large amounts of silver or gold. In England, cheques evolved from letters written to goldsmith bankers, allowing customers to make payments to a third party without withdrawing money themselves.

As banking became more organised, bankers began to print cheques ready for customers to fill in details by hand. Gradually, more features and flourishes were added to the bill, either to convey information or increase security.

Images of cheques from the Barclays archive expose social and technological history, where new techniques have emerged even as cheque usage has declined. As long as this market exists – and 558 million cheques were written in the UK in 2015 – the technology and design will continue to develop, with smartphone-based imaging the latest phase of the evolution.

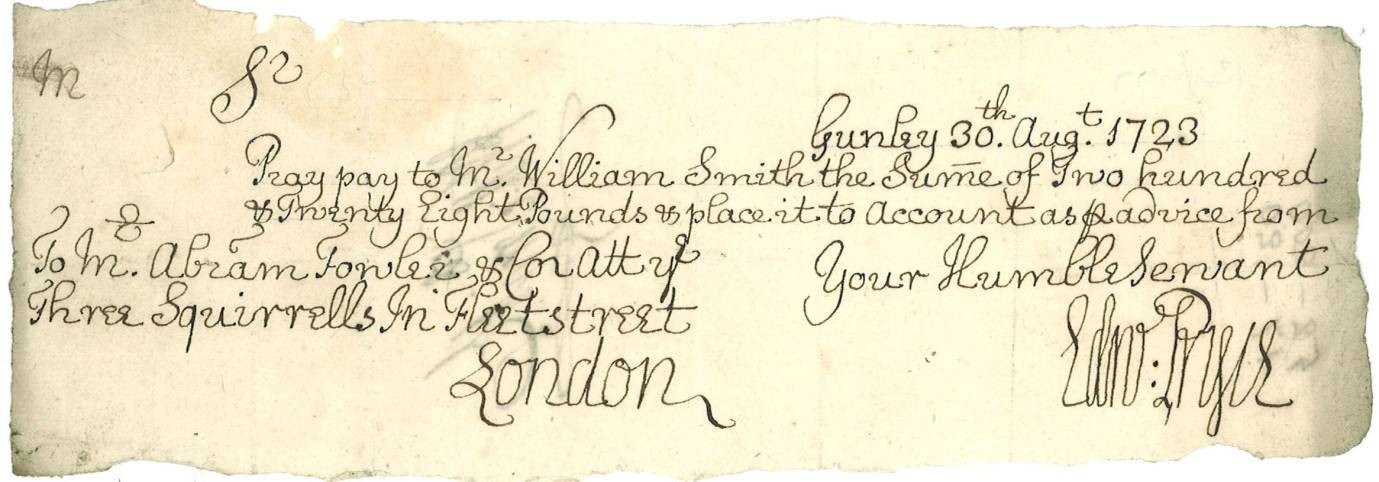

1723

One of the earliest cheques in the Barclays archive: handwritten and without any security feature beyond personal acquaintance with the bearer. The banker named on the cheque is Mr Abraham Fowler, a goldsmith turned banker and a partner of the business ‘at the sign of the Three Squirrels’ on Fleet Street. From 1742 this business was in the hands of the Gosling family, and Goslings was later incorporated into Barclays (the name has survived at Barclays’ current branch at 19 Fleet Street).

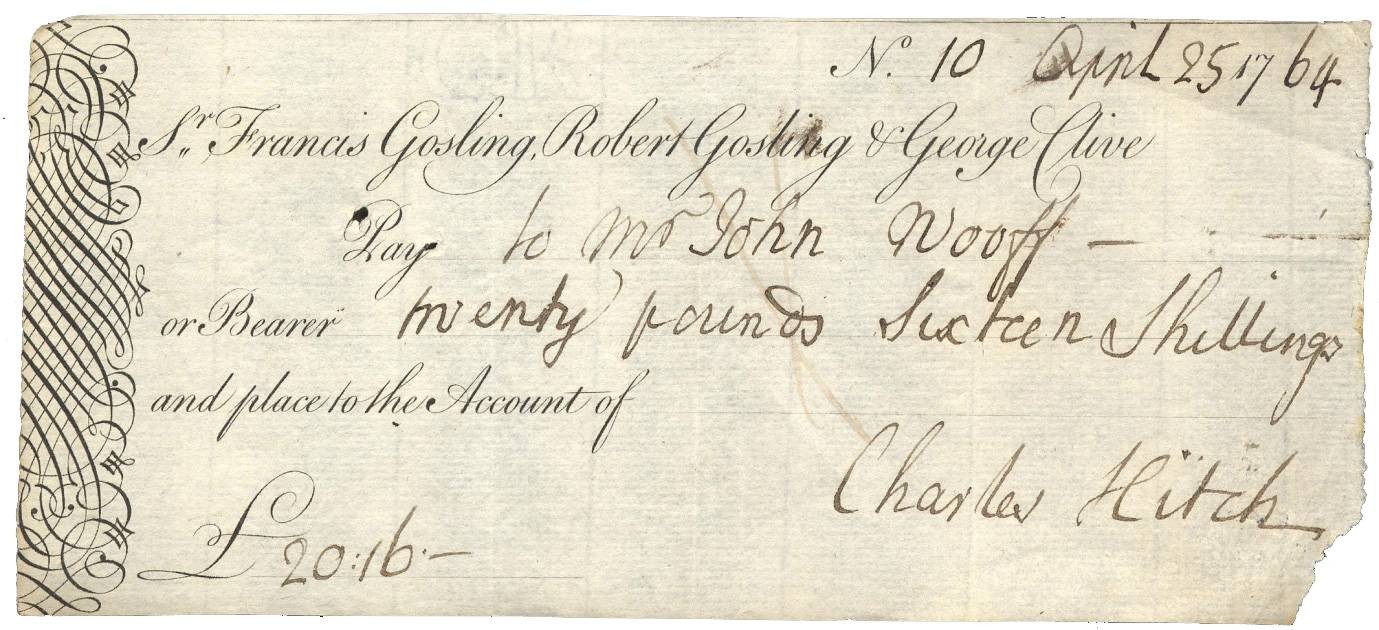

1764

Later in the 18th century, some rudimentary security is in place. Cheques were printed with the name of the issuing bank from the mid-1700s, and the swirled designs to the left of the cheque were an attempt to prevent counterfeiting.

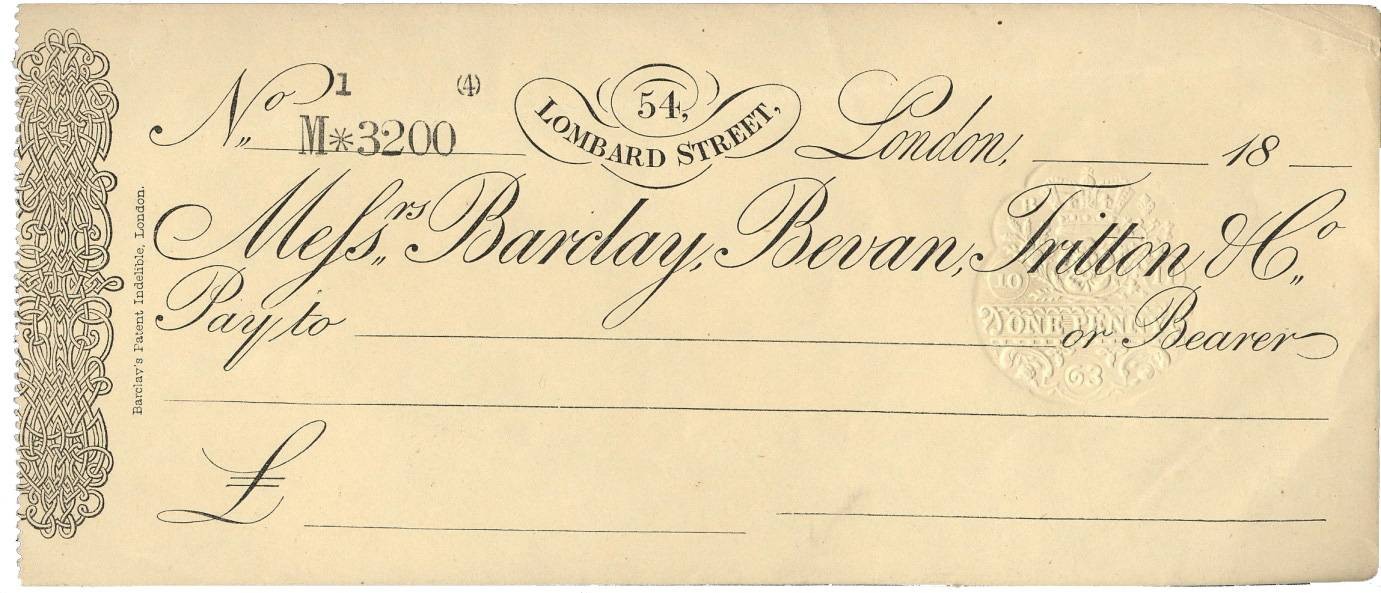

1863

Into the 19th century, and cheques were changing. We see the first appearance of a stamped account number, and the perforations on the edge of the cheque suggest this bill came from a cheque book, first introduced in forms of 50,100 and 200 by the Bank of England in 1830. Barclays remained at 54 Lombard Street until 2005.

1896

A large transfer of funds from the old, private Barclays partnership to the new public company, which was incorporated on 20 July 1896. Written two days after this date, the cheque is signed by Seymour Pleydell Bouverie, the last named in the Barclay, Bevan, Tritton, Ransom, Bouverie partnership.

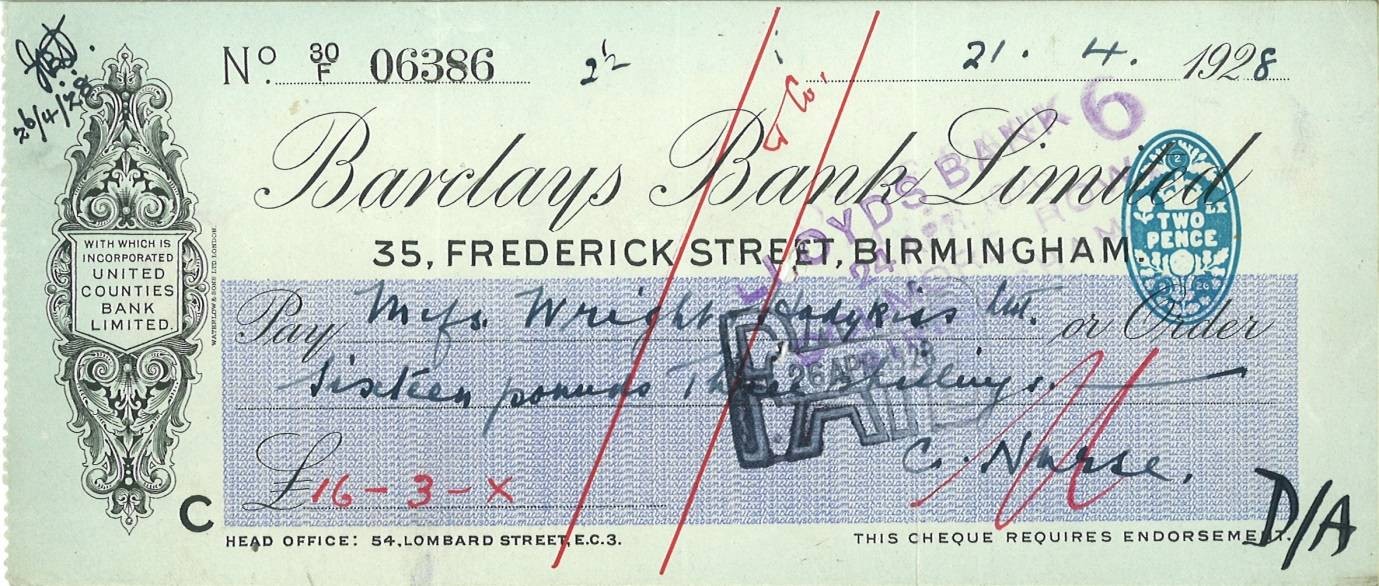

1928

Barclays continued to expand, and the names of the banks they incorporated survived in branch cheque books. Stamp duty was payable on cheques from 1853. By 1929 the government was earning £3.5m a year from the tax. The duty was abolished in 1971, shortly before decimalisation.

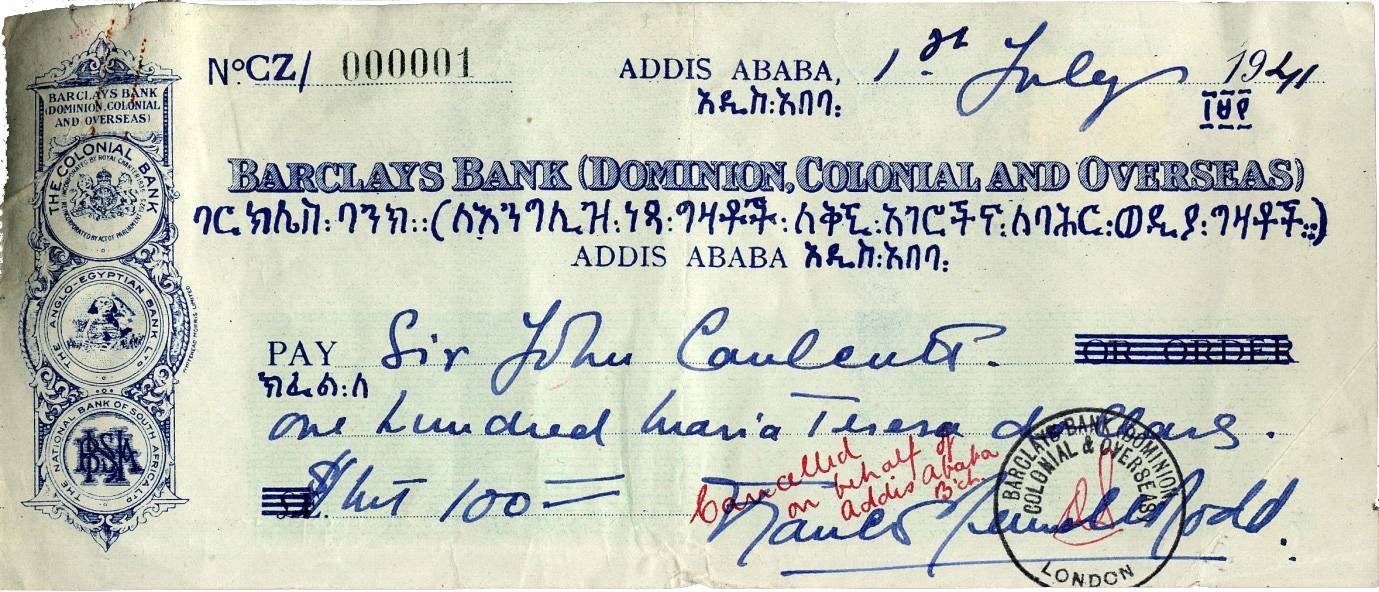

1944

In 1941, Barclays Bank overseas banking arm was ‘invited’ by the War Office to open a branch in Ethiopia to facilitate banking for British troops and the Ethiopian government. The second world war also saw cheques being photographed for the first time using microfilm apparatus, allowing duplicates to be printed for back office purposes.

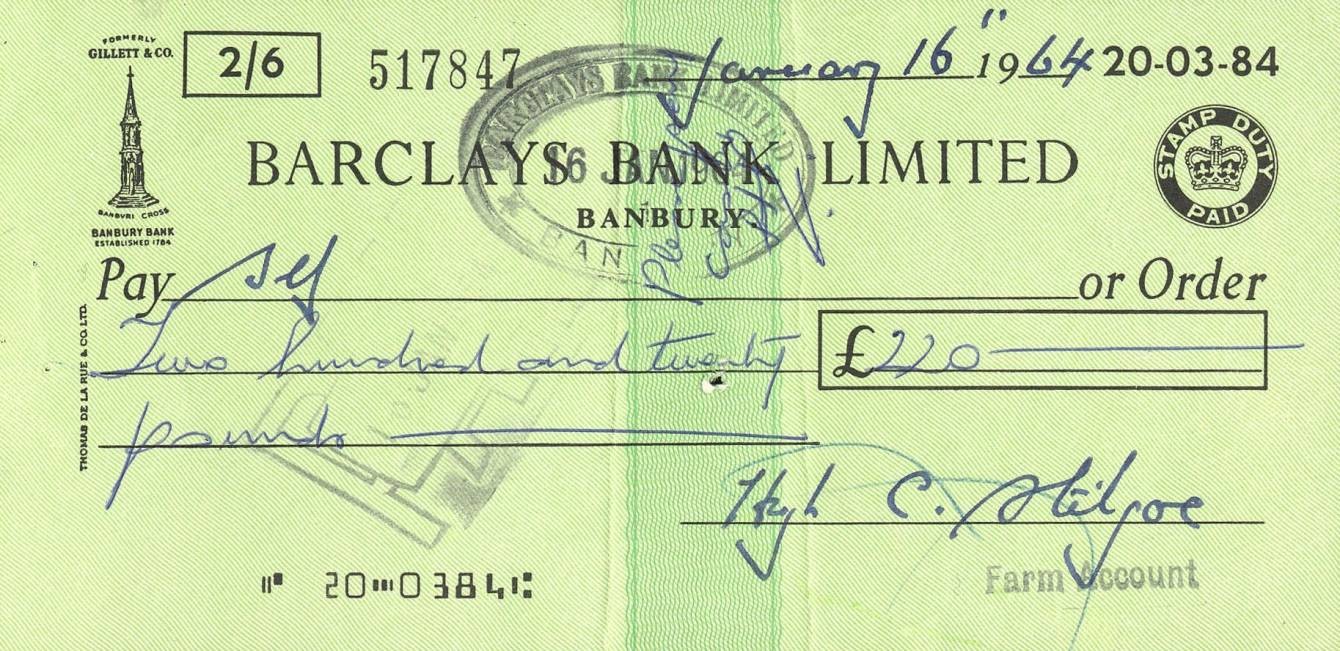

1964

As cheque volumes increased, automation of the sorting process became a necessity. Magnetic Ink Character Recognition (MICR) was introduced. The machine made by De La Rue (who also printed this cheque) could handle 700 documents per minute.

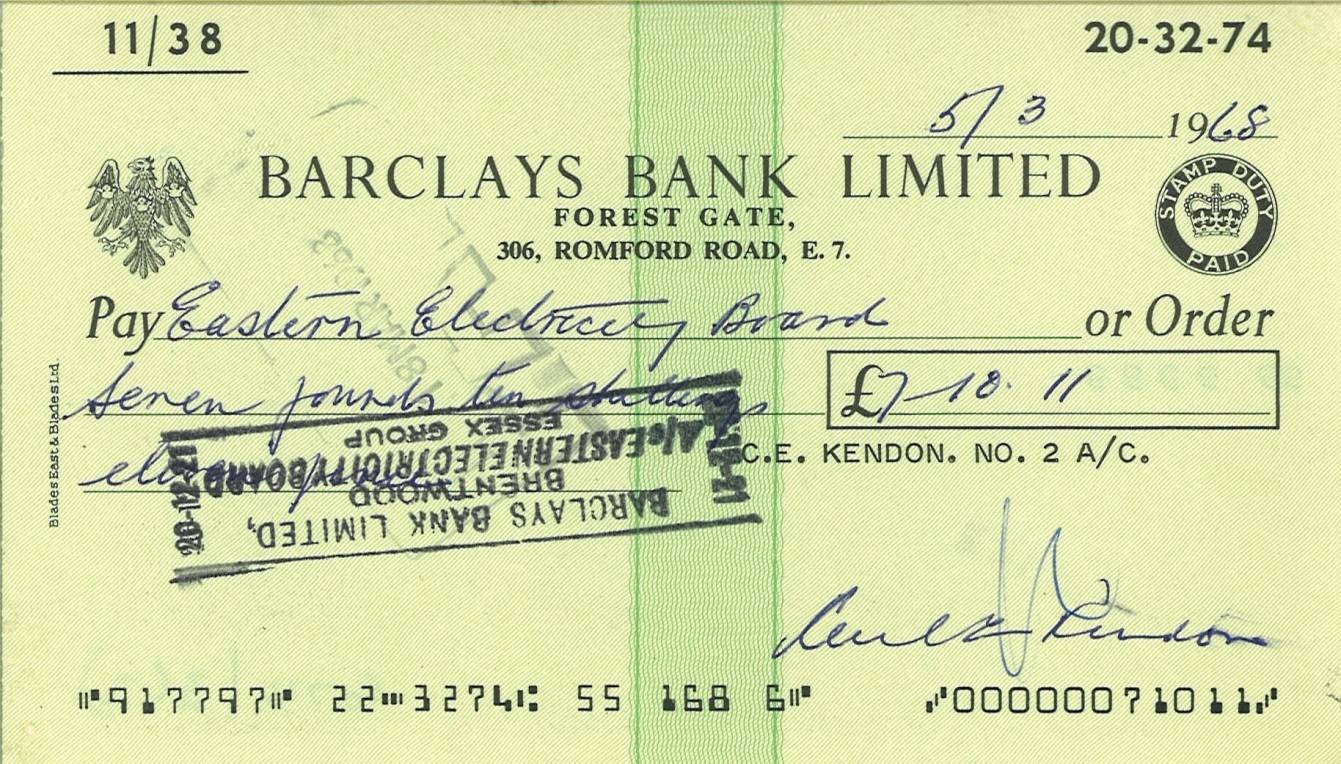

1968

With automation, cheques needed to be made of much stronger paper, and industry standards for weight of paper, layout and font came into effect. By 1968, the MICR covered sort code, account and cheque number. Full automation was introduced into Barclays Clearing Department, allowing it to process 1,600 cheques per machine per minute.

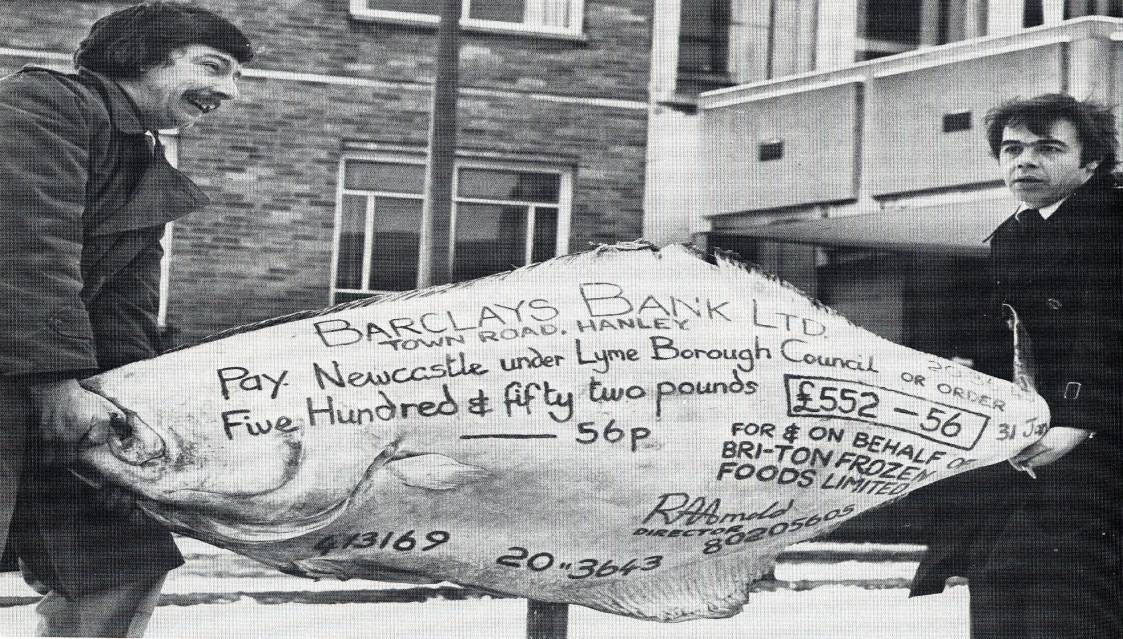

1978

At this time, cheques were legitimate as long as they had the constituent parts correctly filled in and were drawn on a valid account, so this halibut was a legal bill of exchange. The 150lb fish honoured a rates bill to the local council from businessman Randall Arnold, who was reportedly protesting the condition of roads outside his frozen food depot.

1990

Cheque payments peaked in 1990, with four billion written that year. A steady decline has led to suggestions that cheques could be phased out, but banks are committed to keeping cheque clearing open for as long as customers require it. 558 million cheques were used in 2015, with a daily value of £1.7bn.

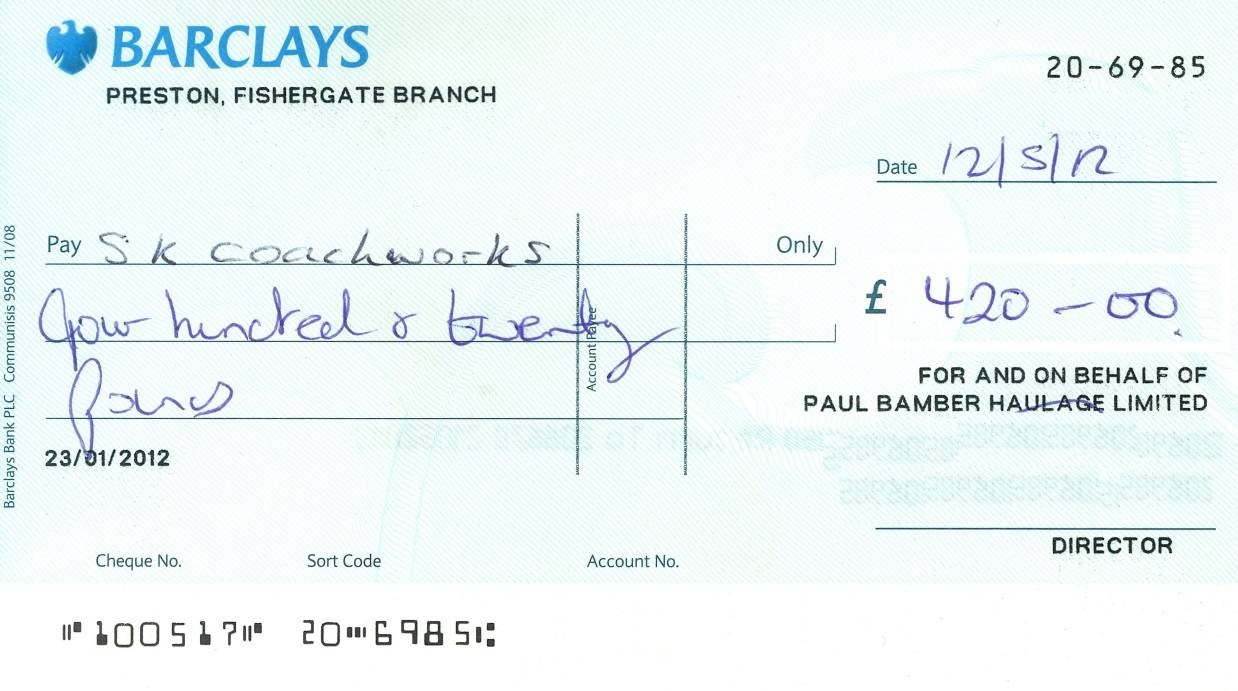

2012

In 2012, Barclays began to route all house cheques through the clearing process, removing the need for manual checks in branch. The final house cheque in Barclays’ history was this one, processed at the Preston Fishergate branch in May 2012.

2016

The biggest change in cheque processing since automation, picture capture technology allows cheques to be deposited directly into a Barclays account through a mobile phone. Cheques processed as images and deposited before 4pm will be paid by noon the next day.