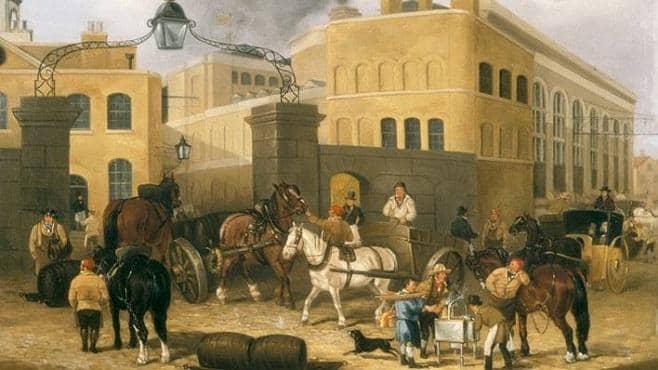

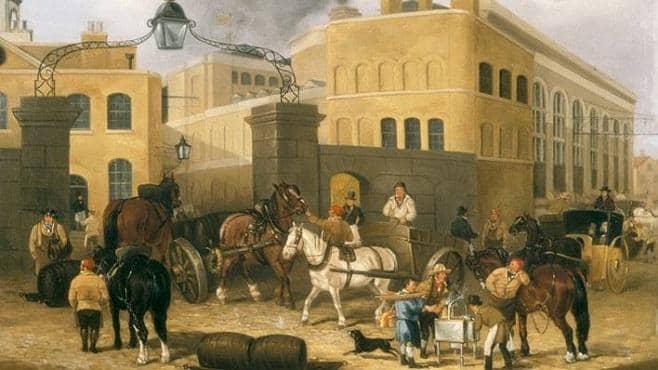

From the archives: Barclay Perkins Brewery

Only a small plaque now marks the place where the Barclay Perkins Brewery once stood in Southwark, south London – but 200 years ago it was the largest brewery in the world

Tottenham Hotspur’s new football stadium is estimated to cost around £750m. But football hasn’t always been awash with money. When Irving Scholar took over as chairman of the North London team in 1982, the club was struggling with £4m of debt, and needed to patch up the financial holes of the over-budget and delayed renovation of the West Stand at White Hart Lane.

Scholar’s answer was, in its time, revolutionary. He sought to raise £3.8m by making Spurs the first sporting club in the world to be floated on a stock exchange. Shares were made available through the London Stock Exchange (LSE) at £1.08 each. The issue was four times oversubscribed.

As receiving banker, Barclays called all hands on deck to cope with demand that stretched to a quarter of a million applications in one day. A cutting from the Barclays archive shows Barclaynews reporting that “staff from other branches, departments and agencies have been called in to help on a number of occasions”.

It wasn’t the happiest of investments. With the cash surge into football from television rights, the Premier League, and the Champions League still a generation away, shares in Tottenham Hotspur PLC fell to 90p on the first day of trading and took over three years to rise above the one pound mark. Fans found that, rather than an investment with dividends, they had bought a further emotional share in the club.

Barclays’ relationship with Tottenham Hotspur stretches as far back as 1898, with signature books from the White Hart Lane branch of London & Provincial Bank (which merged with Barclays in 1918) showing entries from the club, its directors and its players. The Football Association itself has banked with Barclays since 1879.

Barclays treated the Spurs initial public offering as it would any non-football share issue, with the bank’s then Issues Manager, Paul Banning, simply saying: “It has been a busy year for the department, the Tottenham flotation being one of many where Barclays has acted as receiving banker.”

It would be another 18 years before Barclays embarked on its 15-year title sponsorship of England’s Premier League, for whom it remains the official banking partner. Barclays continues to sponsor the Premier League Manager of the Month award and is also active in community activities such as Barclays Spaces For Sports, providing sports facilities in disadvantaged communities.

Meanwhile football initial public offerings (IPOs) move in and out of fashion, depending on circumstances and the sources of capital available. In 2012 Manchester United listed on the New York Stock Exchange at a value of US$1.5 billion. At the same time, Tottenham was delisting from the LSE’s AIM market, with the intention of raising private capital for their current stadium rebuild.

A report in Barclaynews in November 1983 shows staff sorting through some of the 12,000 letters of acceptance that were sent out to successful fans and investors

Only a small plaque now marks the place where the Barclay Perkins Brewery once stood in Southwark, south London – but 200 years ago it was the largest brewery in the world

It’s not every day you see someone strutting around in a three-stripe suit, decked out in the colours of a credit card

In 1972, Barclays relocated hundreds of staff to Radbroke Hall, creating an ‘innovation centre’ in the Cheshire countryside

Barclays Group Archives are home to the records of Barclays PLC and its predecessors, dating from 1567 to the present day