From the archives: Banks in unusual places

Barclays’ commitment to meeting customer needs has seen the bank conduct business in the unlikeliest of places

From Rufus the elephant to discounts at Our Price record stores, we take a nostalgic look through the Barclays archives at how the bank has promoted its children’s accounts through the decades.

'Home safes' were offered to young customers in the 1920s

“Saving rarely has the appeal of a chocolate bar,” admits a Barclays magazine advert from 1982. “It is, however, one of the most important habits you can help a child develop.”

The uphill task of diverting pocket money from the sweet shop to the piggy bank can be charted in a series of adverts and campaigns stored in the Barclays archive. From steel money boxes with slots for shillings and florins offered as “home safes” to young customers in the 1920s – artefacts that fetch more than coppers on auction sites today – to today’s Code Playground, Barclays has long been an innovator in attracting the customers of the future.

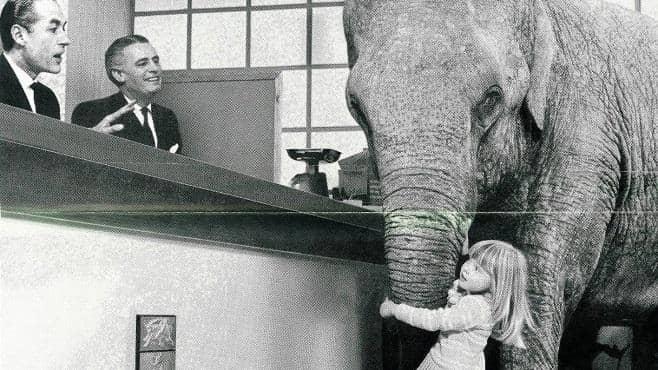

Long before the concept of “brand loyalty” was coined, banks recognised that pocket-money hoarders had the potential to develop life-long relationships with their institutions. Documents in the Barclays archive show the bank – and its predecessor Martins Bank, later taken over by Barclays – used a variety of characters to promote their services to youngsters. Perhaps the oddest is Rufus, an elephant who featured in a 1966 advert in which a young girl brings her very large pet with her to open a savings account at a branch of the “friendly and understanding” bank.

By the 1980s, with the presence of an elephant or the potential for preferential interest rates no longer considered enough, the big banks and building societies engaged in an escalation of clubs and free gifts to attract younger customers. Moneyboxes still played a part, with Barclays’ 1982 version designed as a miniature replica of a bank branch, complete with a combination lock. However, the battle for customers also saw banks delivering sports bags, dictionaries and other branded goods to pre-teens with a pound to open an account.

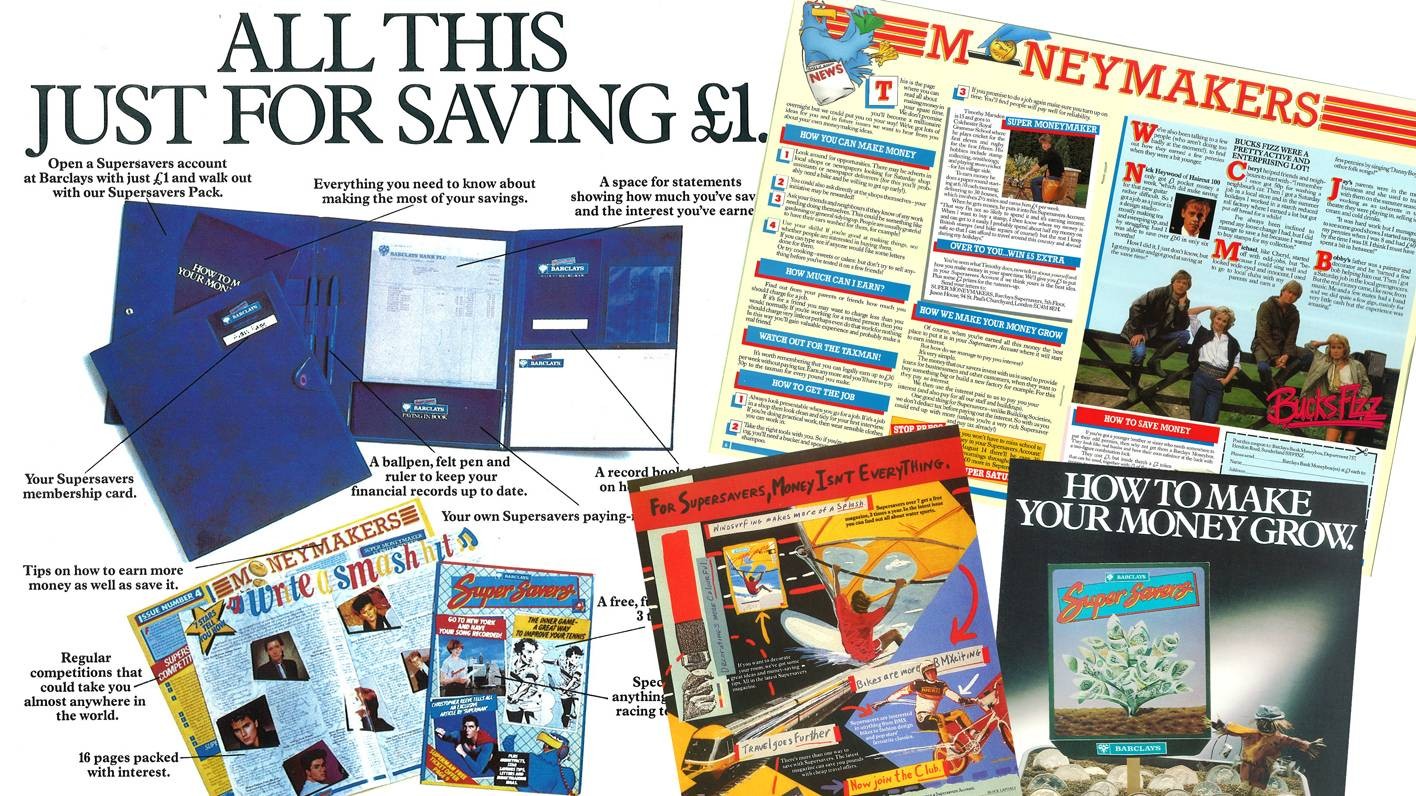

Barclays Supersavers club offered a binder, stationery, a regular Smash Hits-style magazine, and a plethora of competitions to its young members

Barclays Supersavers club offered a binder, stationery, a regular Smash Hits-style magazine, and a plethora of competitions to its young members. A typical issue of Super Saver magazine – brought to you by Barclay the Eagle – would feature BMX tips, the chance to visit a recording studio in New York, and an interview with Spandau Ballet, as well as money-making suggestions, special offers and even rudimentary tax advice.

By the early 1990s, Barclay the Eagle had become Barclay Bill. The moneybox was still a feature for account-holders – this time a cuddly figure of the bird with a coin slot under its hat

By the early 1990s, Barclay the Eagle had become Barclay Bill. The moneybox was still a feature for account-holders – this time a cuddly figure of the bird with a coin slot under its hat. The “Junior BarclayPlus” account also came with “exciting prizes to be won, money-saving ideas and a great cartoon featuring the adventures of Barclay Bill.” At the age of 11, graduating to a BarclayPlus account, promotional material in the archives says that customers would be “able to get discounts on records or tapes at Our Price music stores.”

The current Barclays account for 11 to 15-year-olds – still called BarclayPlus – allows benefits unthinkable to earlier generations of savers, where giving seven days’ notice to withdraw money from an account was common. Now, contactless debit cards (personalised with a favourite photo) allow the withdrawal of up to £300 a day from ATMs. For better or worse, there’s not an elephant in sight.

Barclays’ commitment to meeting customer needs has seen the bank conduct business in the unlikeliest of places

From the moment the velvet curtain was drawn back at a Barclays branch in London’s Enfield, the way we bank was altered forever

It’s not every day you see someone strutting around in a three-stripe suit, decked out in the colours of a credit card

Barclays Group Archives are home to the records of Barclays PLC and its predecessors, dating from 1567 to the present day