Growth markets

Capital markets fund growth and play an important role in supporting everyday business, but, says Barclays CEO Jes Staley, “the function capital markets play has been much misunderstood”. Writing in the latest in a series of reports aimed at demystifying their role – published today – Jes argues that our long-term prosperity relies on “the ability of capital markets to be safe, efficient and easy for aspirational businesses to access”.

In the UK, more than £4tn of capital is invested in capital markets through the pension funds, insurance policies and the individual savings of more than 30 million people. Last year, companies in the UK raised more than £300bn in capital in the bond, loan and equity markets, which provided four times the amount of funds to companies than traditional bank lending.

As part of its drive to demystify the crucial role of capital markets in the UK economy, Barclays has once again partnered with the think tank New Financial to publish a new report. The report analyses the benefits accrued to England’s North West region as a result of capital markets activity.

Writing in the forward to the report, Barclays Group CEO Jes Staley argues that a lesson from the financial crisis is that “we must shift away from relying on traditional bank lending and instead broaden the means through which businesses and entrepreneurs access capital and financing. The answer lies in healthy, diverse capital markets.”

He calls these markets “a centuries old innovation, born in Europe, flourishing in America, but which remains underdeveloped and misunderstood here. I believe that needs to change.”

Today’s report – The Impact of Capital Markets on People’s Everyday Lives – builds on last year’s report, which looked at the central role of investment banks in driving growth. The authors note that “the further from London you go, the less relevant capital markets may seem to the functioning of the day-to-day economy and to people’s everyday lives.”

To counteract that impression, it identifies more than 900 companies, employing over 600,000 people, using capital markets in the region. An estimated £70bn in funding is being put to work in the local economy, while the combined pension assets – most of it invested in capital markets – of people working and living in the North West is more than £200bn.

Staley says: “The results are fascinating and are the first time anyone has studied the role of capital markets regionally.” He adds: “Whilst not always obvious, the ability to access the global capital markets has allowed the North West to thrive and amplify the potential of its highly talented workforce.”

Everywhere you look

Staley believes that the report addresses an assumption that capital market activity is “very London-centric and self-serving, with only those within the industry benefiting from them”. He says that the whole UK economy will thrive through having a wide range of funding options, and the deeper pool of capital in the UK markets leads to an increase of choice for businesses seeking investment.

“Our long-term prosperity, be that individually through our pensions or economically through having a diverse economy, depends to a large degree upon the ability of capital markets to be safe, efficient, and easy for aspirational businesses to access.”

The report is a reminder that beyond the amorphous terms of ‘the City’ and ‘the financial services industry’ lies a simple equation of companies seeking investment and investors seeking returns. Behind the scenes, capital markets are also shown to help companies manage risk and cashflow to secure their growth, while individuals benefit from cheaper mortgages, credit and insurance, and better pension returns, through institutional investors’ use of the markets.

As an Investment Bank, Barclays is a bridge between those who seek investment opportunity and those who need financing to grow, evolve or innovate. The bank ultimately connects organisations looking for financing with people looking to put their money to work.

“One of the privileges of being CEO of Barclays,” says Staley, “is the opportunity to engage with our wide range of clients. Experience tells us that when businesses want to go from good to great, they often have to diversify their funding options and tap into the vast potential offered by global capital markets. This is often the differentiator that allows them to rise to their full potential. It’s only through having access to a wide range of funding options, not just traditional bank lending, that the entire economy will rise.”

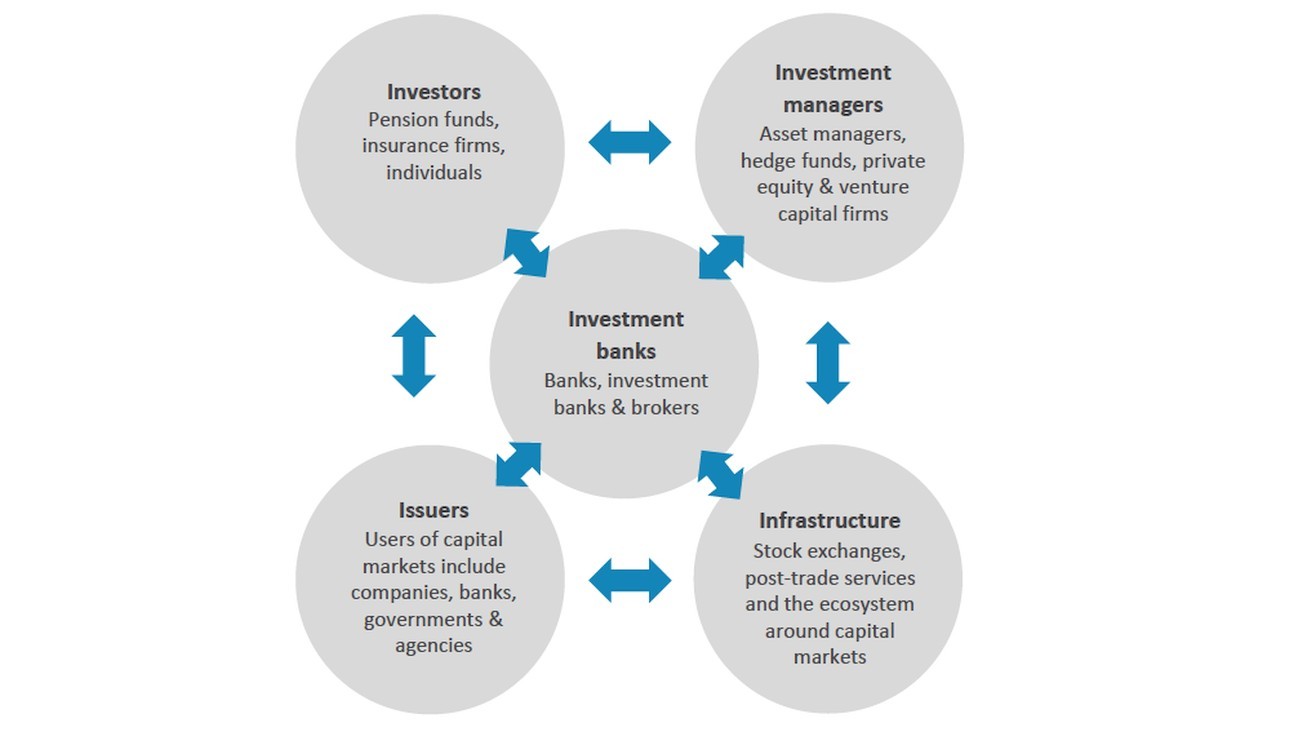

The main participants in the capital markets an how they fit together