History

From the archives: British banking’s first computer

In a historic moment, Barclays became the first British bank to introduce an electronic computer in 1959. Later, in 1961, the bank launched Britain’s first computer centre. The move – which established the bank's reputation as a leading technological innovator – was met with both enthusiasm and, as the archives show, suspicion of this novel technology set to transform banking.

In a revolutionary move, one that would change the face of modern banking forever, Barclays became the first British bank to order a computer in August 1959.

Prior to the introduction of the Emidec 1100, which cost £125,000, bookkeeping had been done by hand in large, leather-bound ledgers. Later, during the First World War, accounting machines were slowly introduced and continually improved – but were still described as modest typewriters with an adding box attached.

The move to introduce a computer – or, as it was known at the time, an ‘electronic bookkeeping system’ – was led by an Electronics Sub-Committee set up by the Committee of London Clearing Banks (CLCB) in 1955.

While it was clear that computers were the next step forward, those involved in its implementation expressed a mixture of curiosity, enthusiasm, and even suspicion.

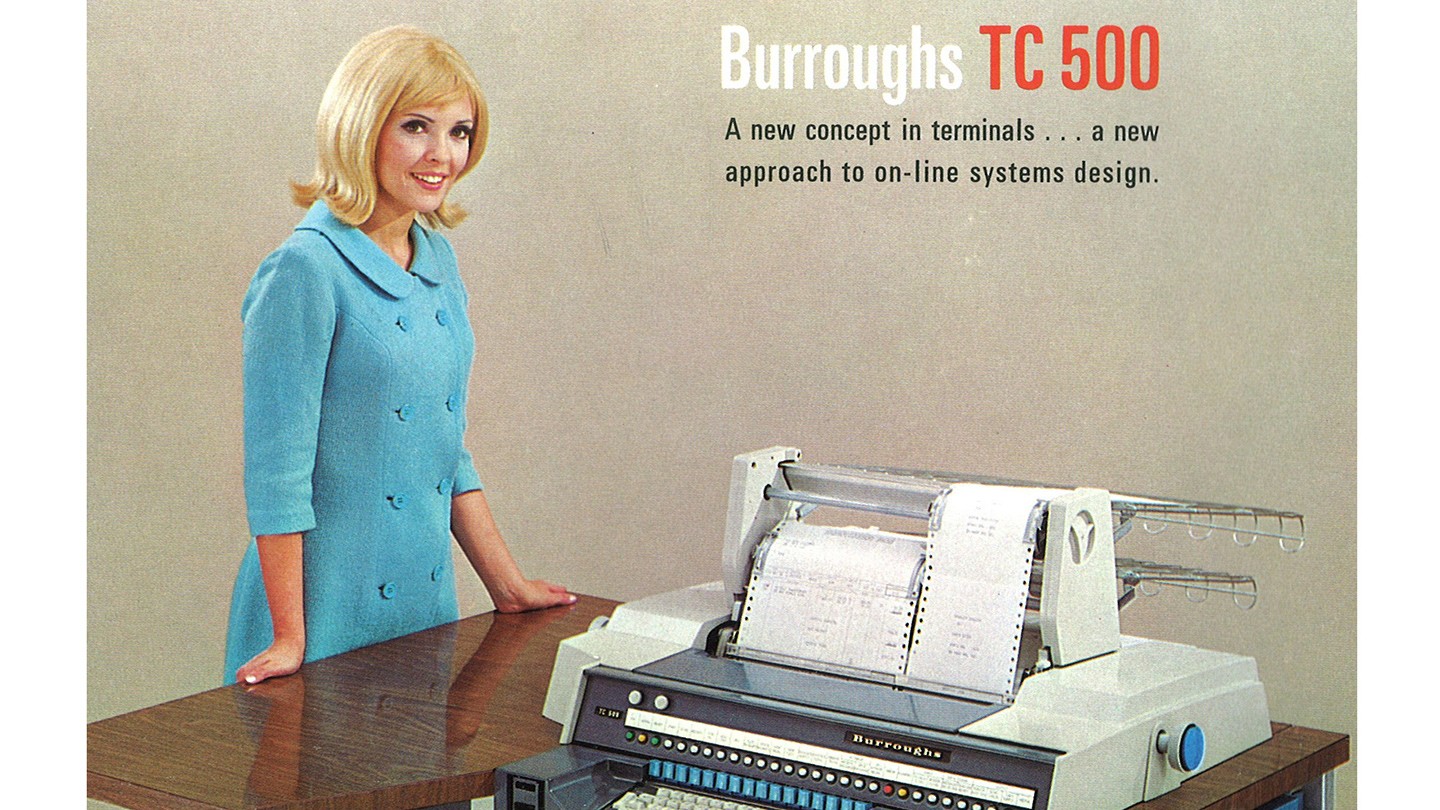

Heather Tring, a machine operator at the Watford Junction branch, feeds information into a Burroughs TC 500 terminal linked to the bank’s new computer centre at Willesden, London (1969)

The computer was thought to be an efficient solution to the bank’s rapid post-war growth – which had seen the number of cheques, credit slips and customers rise at a fantastic rate. It was also seen as an opportunity to reduce what could often be monotonous and repetitive work for bookkeeping colleagues.

“An essential feature of modern progress”

Indeed, in an edition of the Barclays staff magazine Spread Eagle (1959), an article titled ‘A Computer in the Bank’ reassures staff that the “glamour of the computer” would not leave them overlooked but would in fact, provide them opportunity to acquire specialist knowledge and skill. “Which one of us,” it goes on to ask, “does not like to hear of the probability of reduced routine work?”

The computer was earmarked for its speed, accuracy, ability to save human labour and above all its status as “an essential feature of modern progress”. While this was reiterated by Chairman Anthony Tuke in his address to staff (1962), his speech, and documents from the time, hint at the fear of this novel technology.

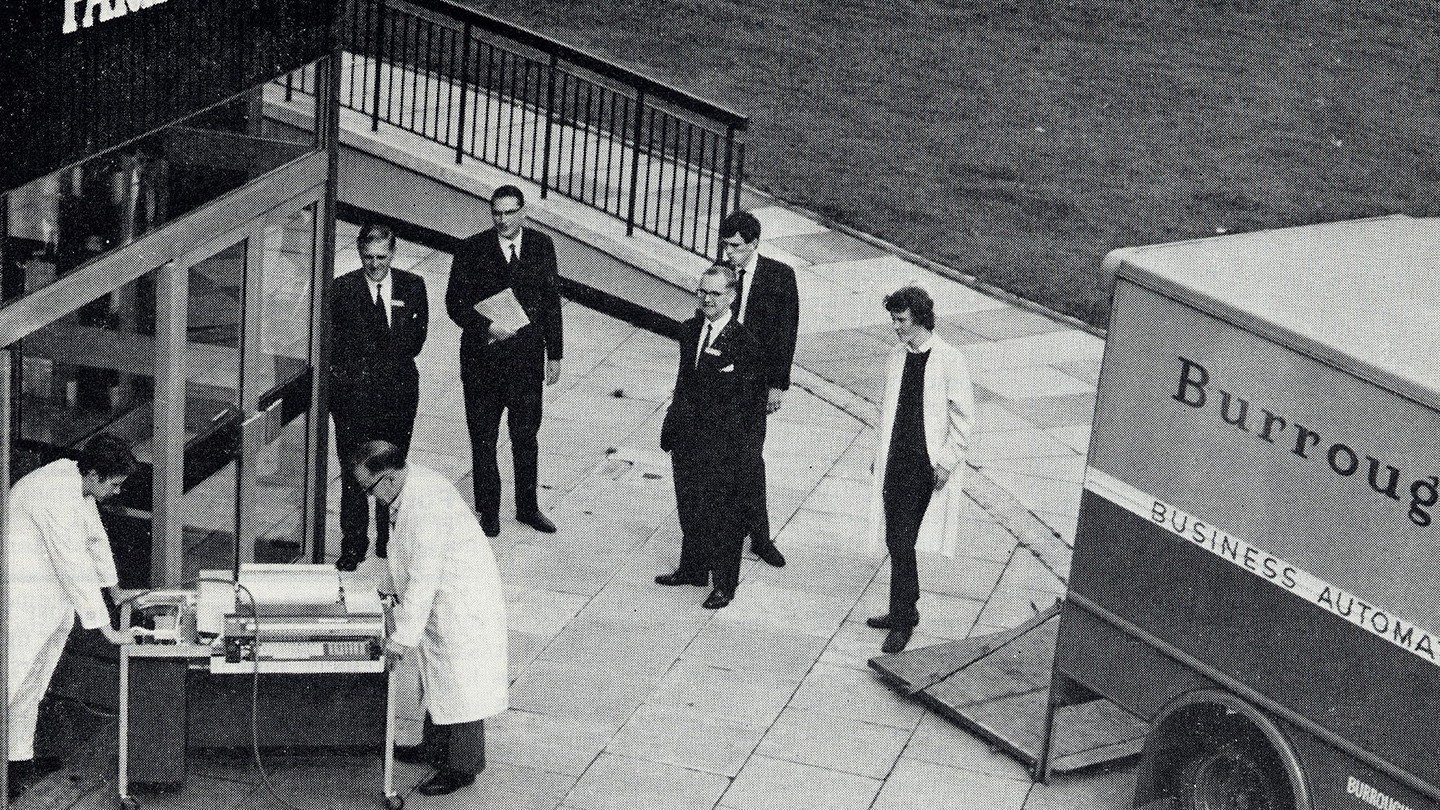

The first TC 500 is manoeuvred into Barclays’ Teddington Training Centre. From the staff magazine, Spread Eagle (Oct 1968)

Tuke’s praise of the computer – and report that the bank had ordered a second model – it tempered by his concern that, for all its benefits, it would come at the cost of quality customer service and human interaction. He states: “They have a regrettable aspect, in that they are destroying the traditional craftmanship for which this country used to be famous.”

He goes on to relate a story about a ledger keeper from the ‘golden days’ of bookkeeping who kept “a quill pen behind his ear” and would report changes in customers’ accounts by simply telling the manager directly.

Britain’s first computer centre

Despite some hints of hesitancy, Barclays continued to spearhead the banking revolution after launching Britain’s first computer centre for banking in July 1961 on Drummond Street, London. Opened by the Postmaster General, the Right Hon. Reginald Bevins MP, the event was much anticipated and widely reported.

The computer centre itself was the very image of modernity, with its interior being described as “futuristic” and, as the staff magazine boasted, it featured all the “modern amenities” such as dust free, temperature-controlled lecture rooms and training wings.

Burroughs TC 500 training manual (1960s)

Automated branch bookkeeping was later introduced at Cavendish Square, London, initially using an NCR device (National Cash Register) before switching to the Burroughs TC500. The introduction of such a model enabled the bank to feed information about customers’ accounts to the central computer. This was the first time that such information was available anywhere other than at a branch.

While the staff had to adapt to the idea of an ‘electronic bookkeeping system’, customers did too. Pamphlets titled ‘Our First Computer’ were distributed to customers explaining that accounts would no longer be written records but instead kept on computers on reels of magnetic tape. The pamphlet quashed any worries customers might have had by reassuring them that staff, released from onerous accounting tasks, would be better available to serve them.

The technological revolution continued, and in 1964 Barclays ordered the iconic IBM 1460 model for the Lombard Street computer centre. Each London City network branch was given an IBM 360 to feed information directly into the computer at Lombard Street.

The swathe of innovation steadily continued, reaching a high-point in 1971 as the computer centre opened at Wythenshawe, Manchester, gained status as the largest building in Britain used specifically as a commercial computer centre.