History

From the archives: remote banking, 19th century-style

We think of remote banking as a 21st century phenomenon, but recently discovered scrapbooks in the Barclays archives show a late-Victorian predecessor: ‘out-tellers’ who made visits to clients’ homes and workplaces, saving them the risk of carrying money on the street.

Liverpool in 1888, and the port city was in the grip of street gangs such as the Cornermen and the High Rip. With booming commerce and trade but the ever-present threat of crime, merchants and shopkeepers who were customers of the Bank of Liverpool (which later merged with Barclays) were faced with the simple problem of how to safely transport their takings to local branches or the bank’s Water Street head office in the city.

Over a century before innovations like in-app banking and cheque imaging, the bank pioneered convenience banking by hiring ‘out-tellers’ to collect money from clients’ homes and businesses. For security, out-tellers were provided with leather pouches fastened around their waists with a chain to prevent their cargo being snatched by thieves. Because of their chains, the out-tellers were nicknamed ‘Bank Monkeys’.

Starting his working day at 10am, an out-teller would usually return to the bank by 3pm carrying heavy loads of cash, gold and silver. As a rule, they were not supposed to accept more than £2 in silver from each client, but they often accumulated to £20 or £30 in silver as well as gold and banknotes.

The tellers walked the streets of Merseyside from 1888 into the mid-20th century. The Bank of Liverpool merged with Martin’s Bank in 1918 and Martin’s was taken over by Barclays in 1969. Now, six scrapbooks compiled by out-tellers between 1888 and 1918 have been found in the Barclays archives. Drawings, photographs and cuttings give some idea of the workers’ spirit and their day-to-day lives.

From the scrapbooks

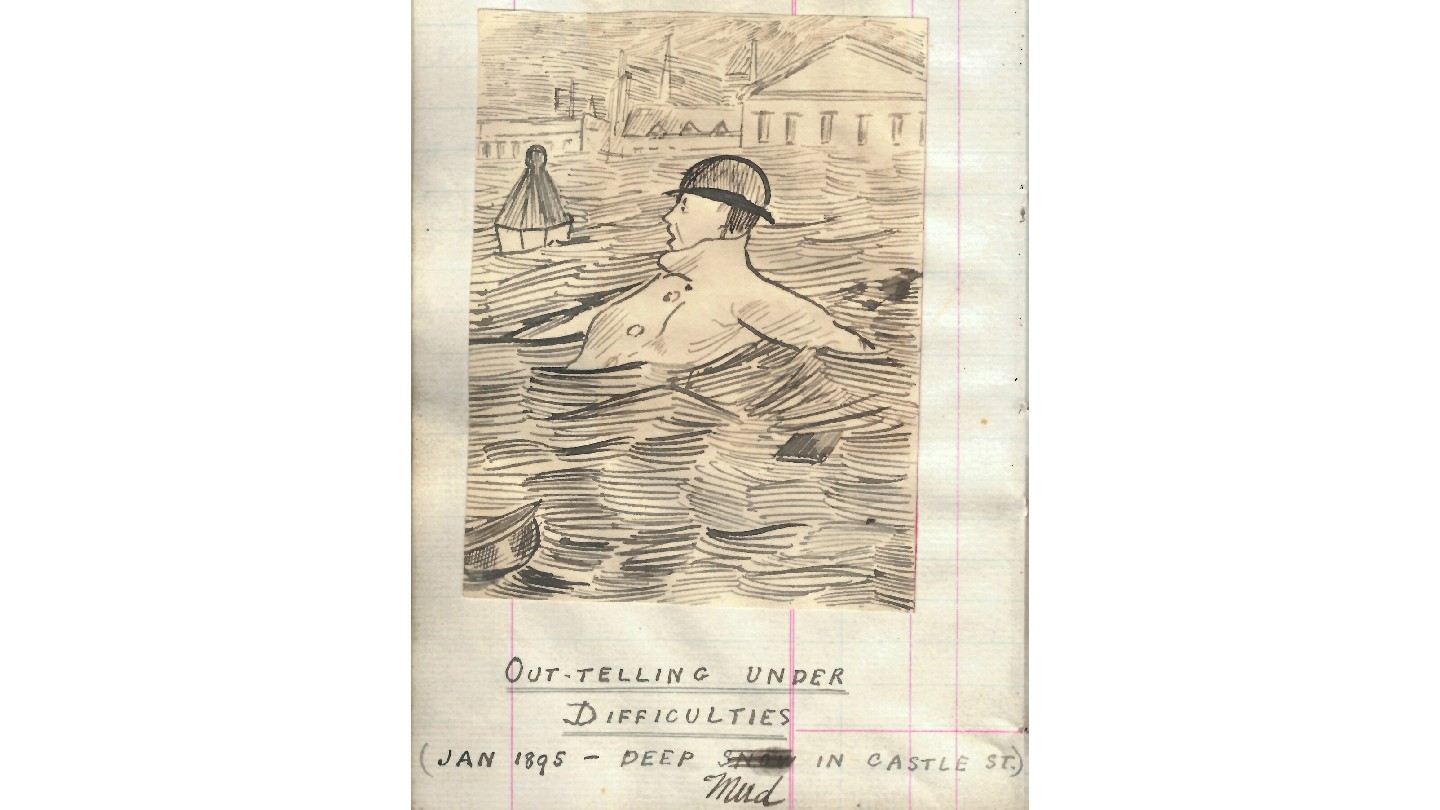

Out-tellers often faced difficulties with the weather (although this sketch from 1895 might be an exaggeration!).

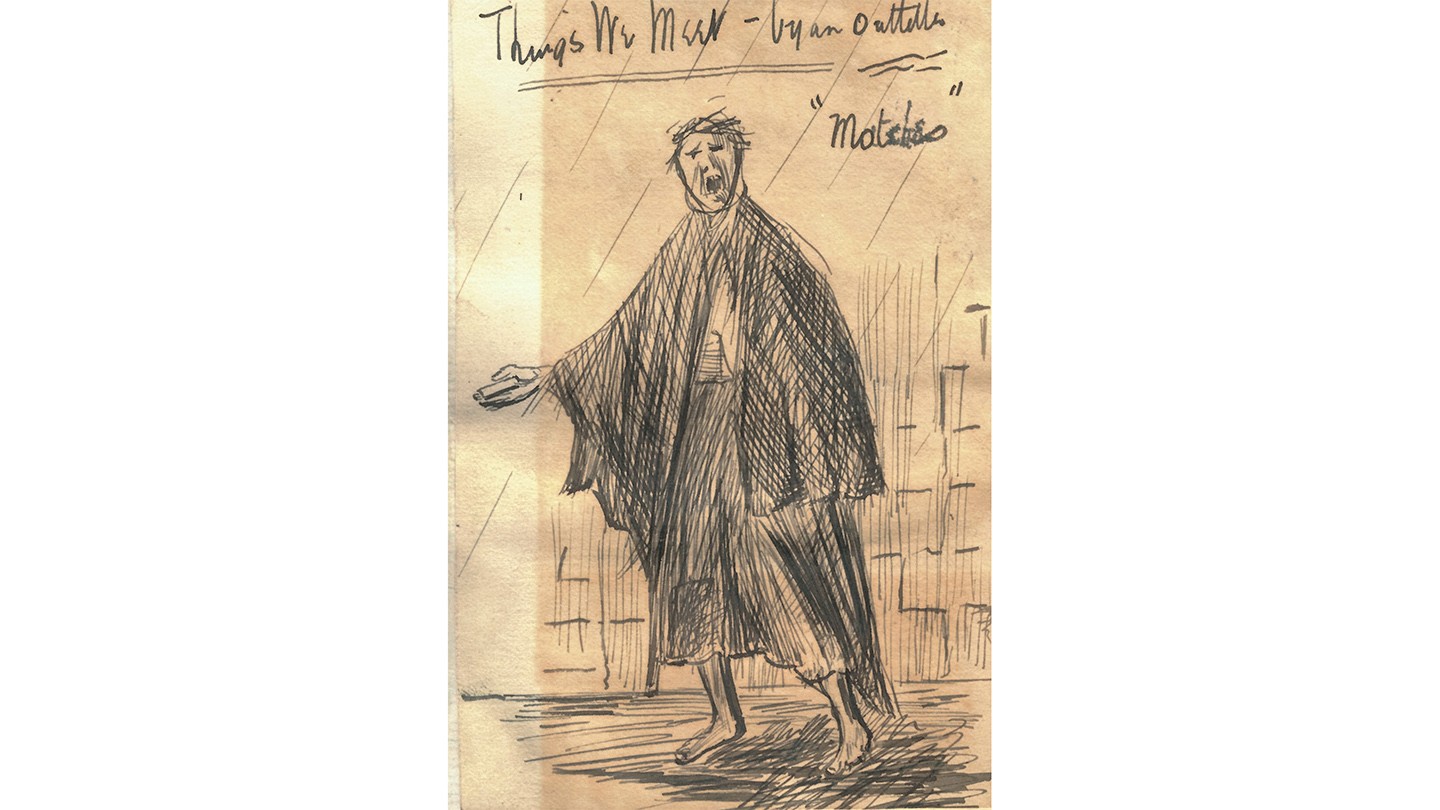

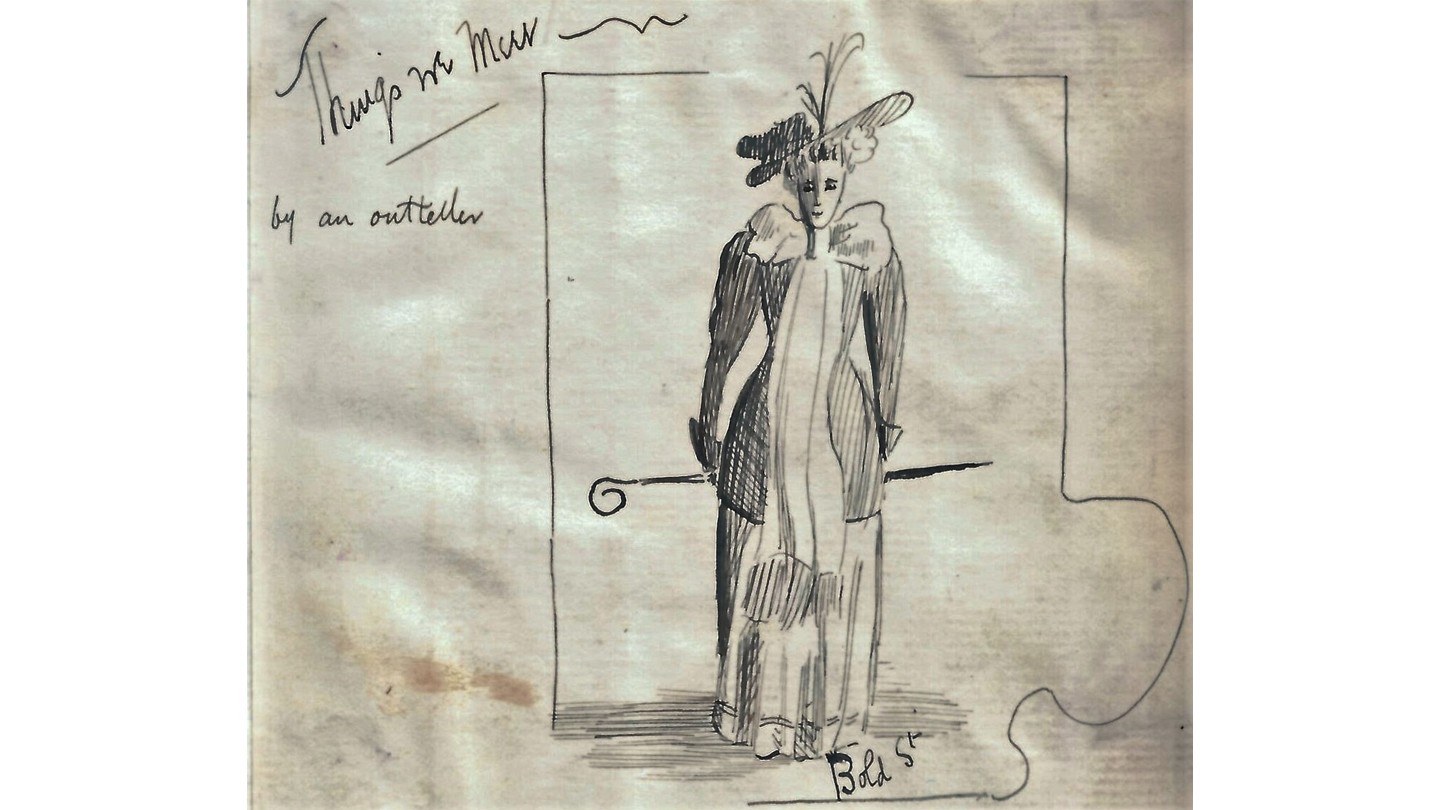

Out-tellers would often make sketches – titled “things we meet” – of the people they encountered, giving a fascinating insight into the street life of Liverpool from 1888 to 1918.

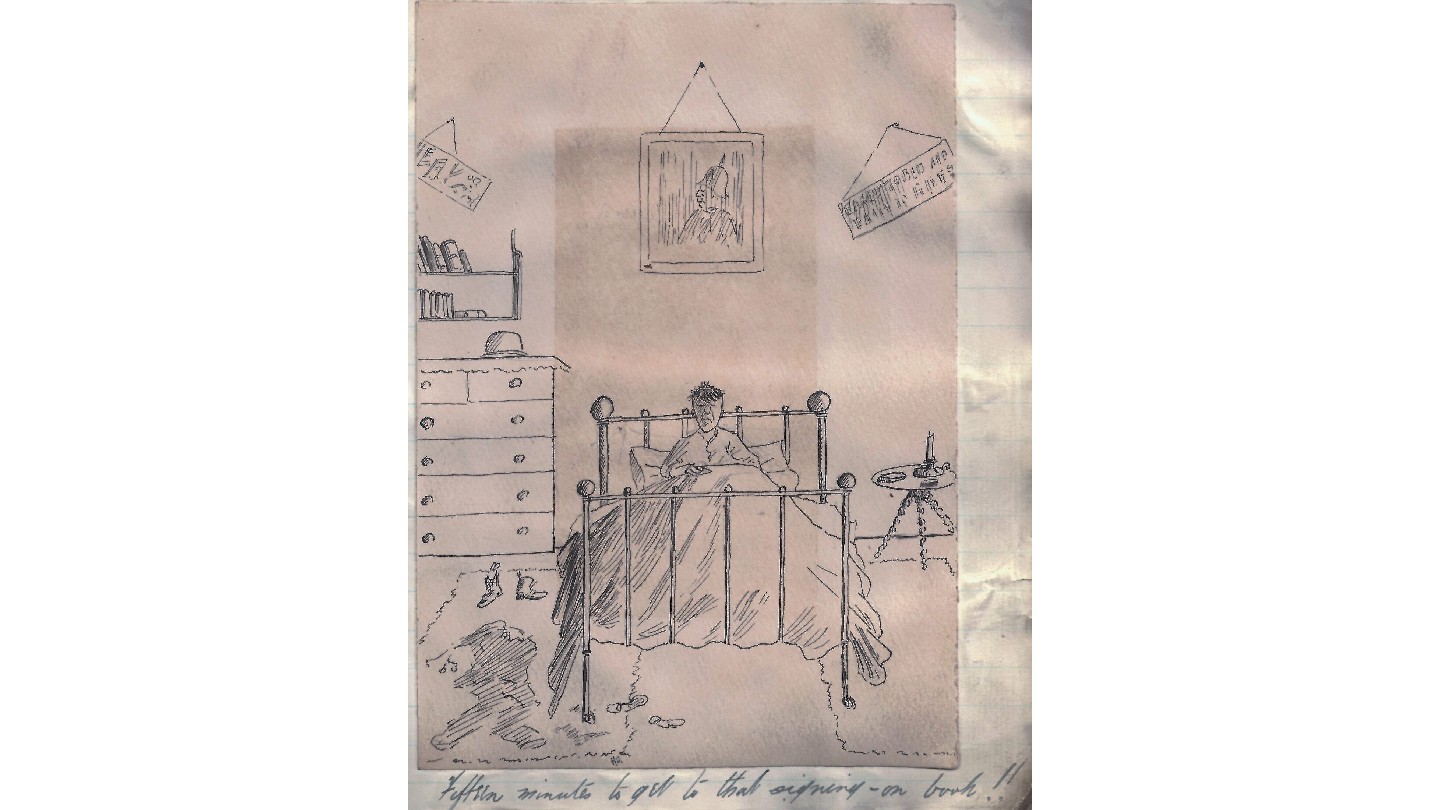

An out-teller cartoon with the caption “Fifteen minutes to get to that signing-on book!!” (1897)

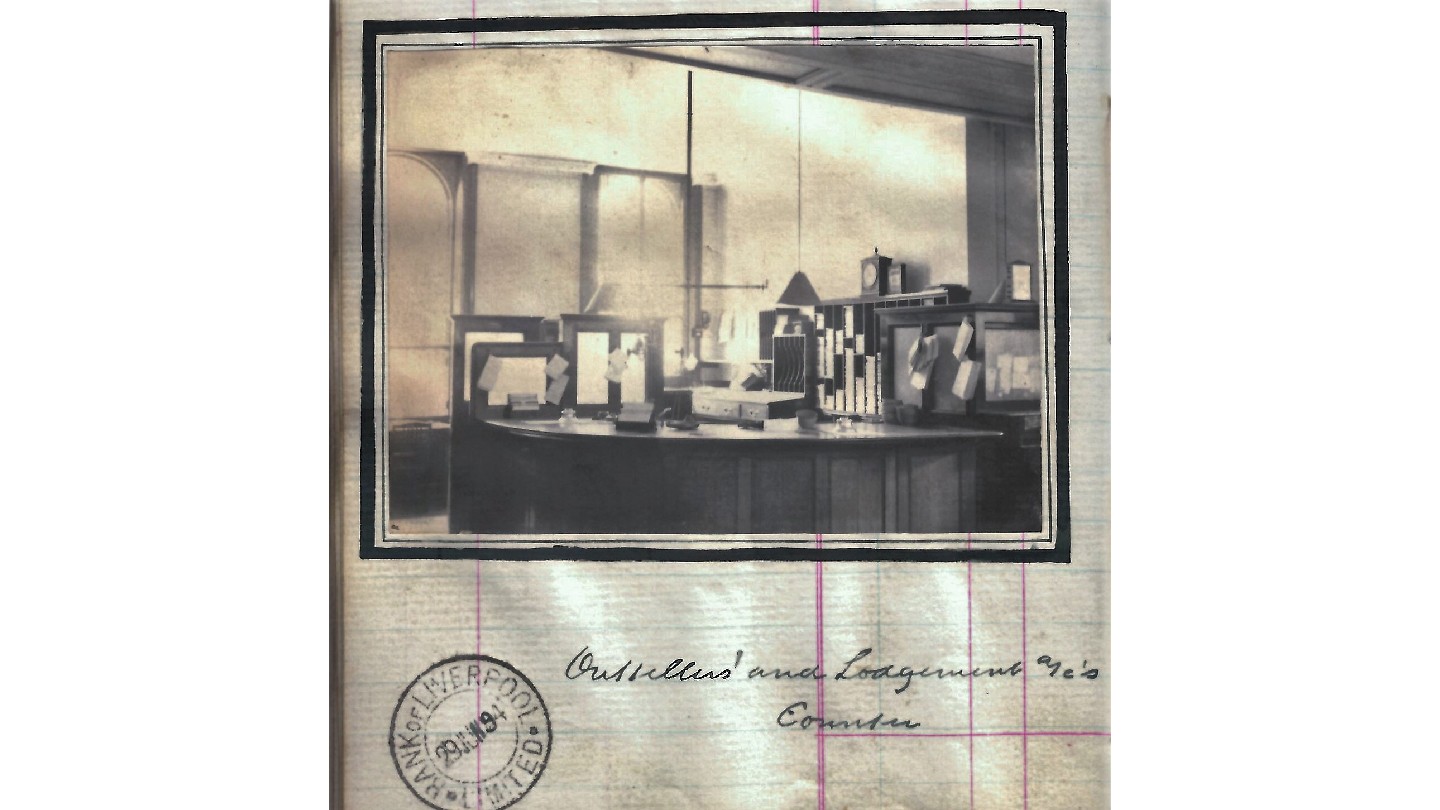

HQ: The Out-tellers and Lodgements accounts counter in Water Street, Liverpool (1894).