From the archives: paving the way in tech innovation

25 March 2022

For decades, Barclays has been at the forefront of exciting new technological innovations – from groundbreaking computers to credit cards. We explore some of the tech ‘firsts’ that the bank achieved during the 20th century.

1959: Emidec 1100, the first British banking computer

The summer of 1959 saw Barclays take an innovative step forward, when it became the first British bank to order an electronic computer.

While colleagues had previously worked largely by hand and with accounting machines, the Emidec 1100 introduced an electronic bookkeeping system to the bank – with the aim of reducing repetitive work and increasing efficiency. In an age of post-war growth, which had led to a rapid rise in customers, cheques and credit slips being processed through the bank, this productivity boost was much-needed.

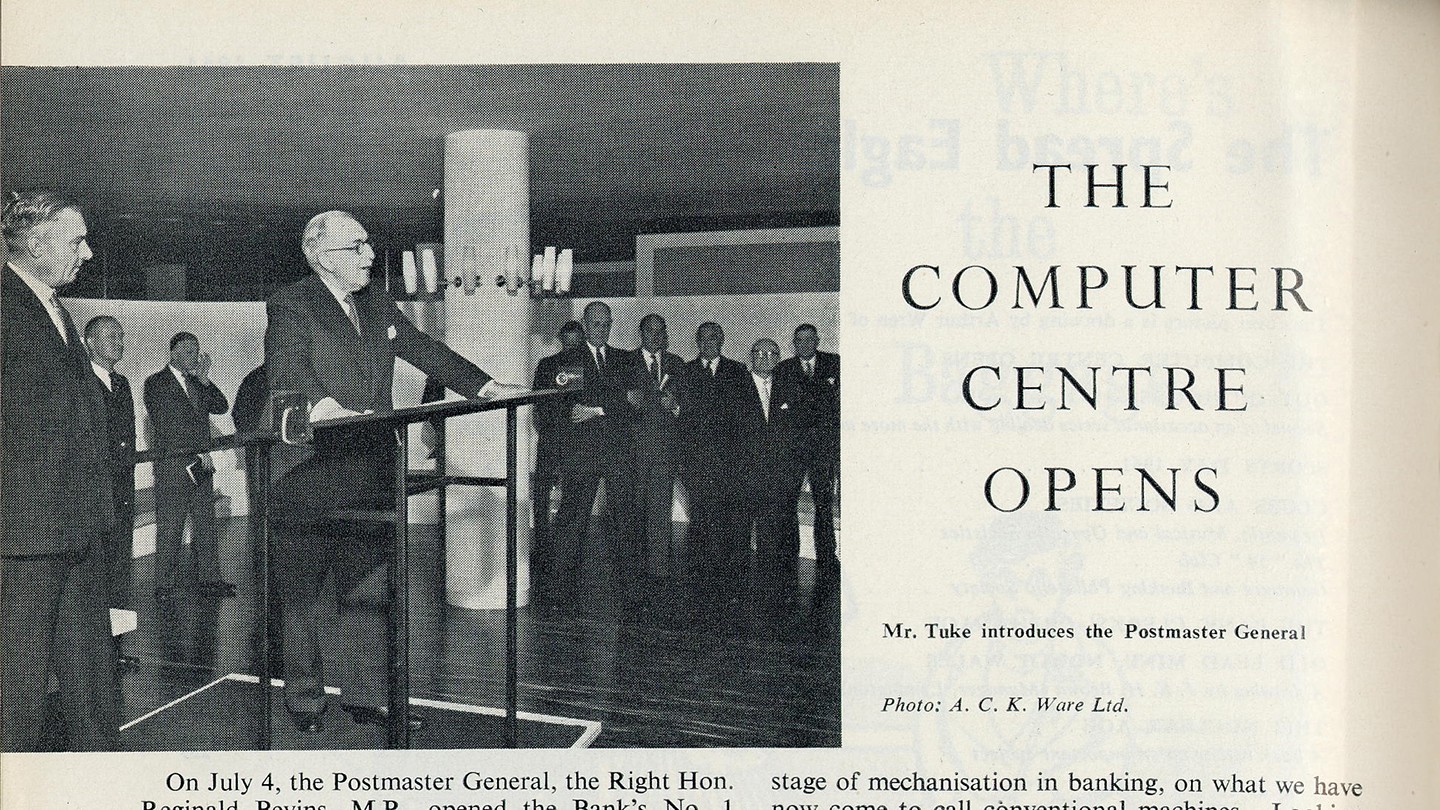

In July 1961, Barclays launched Britain’s first computer centre for banking in the West End of London, UK. According to staff magazine the Spread Eagle, this event “marked the official beginning of the most revolutionary step yet taken by the bank in the development of bookkeeping techniques… believed to be the most advanced in the world”.

Barclays launched Britain’s first computer centre for banking in 1961.

1966: Barclaycard, Britain's first credit card

The release of Barclays’ first credit card sparked a major shift in banking and shopping habits.

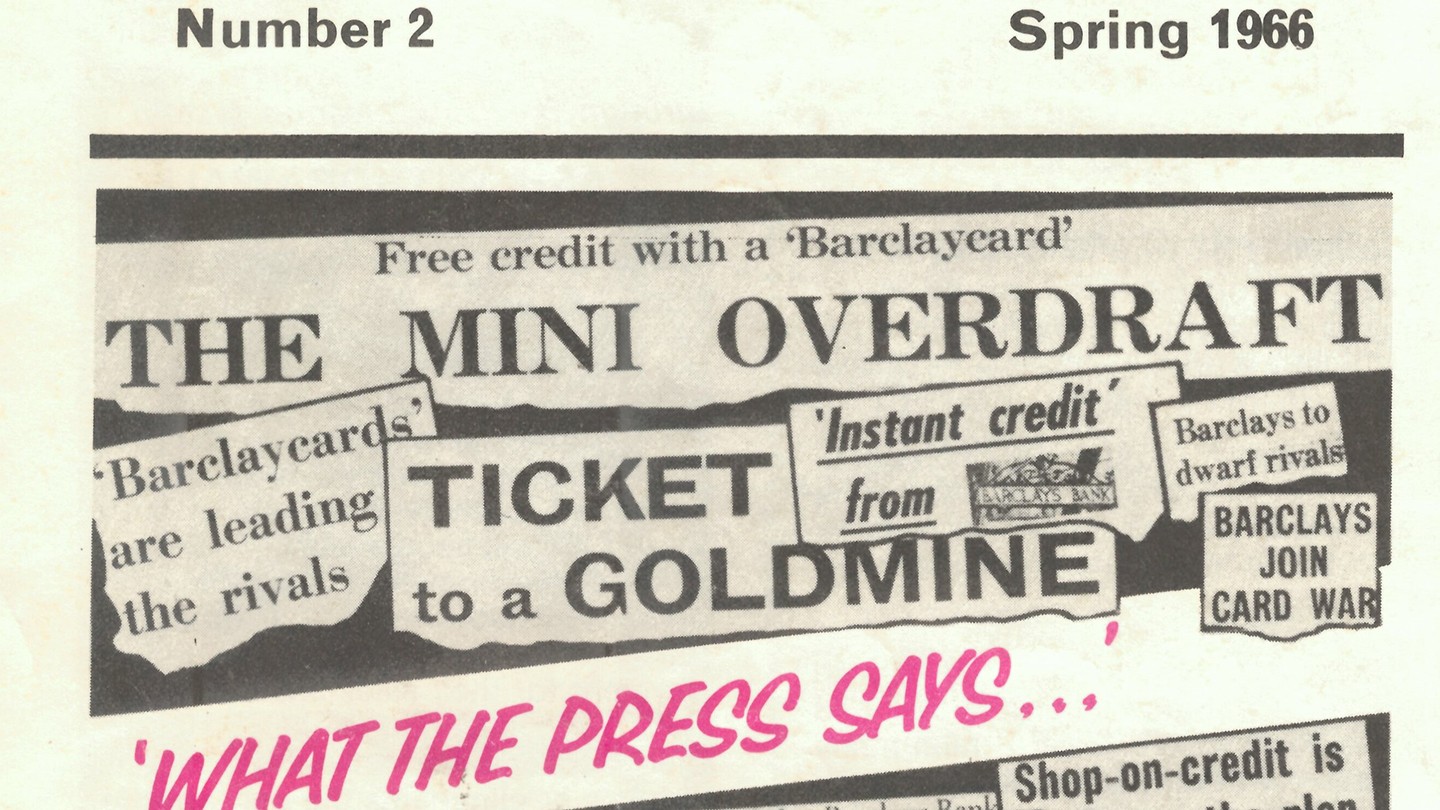

In 1966, Barclays made a momentous announcement: within a year, the bank would be launching Britain’s very first credit card. Just six months later, the Barclaycard was released – and the press campaign that brought it to households across the UK was unlike anything attempted by the bank thus far.

During a time when financial advertising was generally staid and polite, the bold, eye-catching adverts promoting Barclaycard, as well as its many selling points, caught people’s attention.

The project – which aimed to sign up one million cardholders by the June launch date – was so ambitious that it required special postal arrangements. As the Spread Eagle reported, “The size of this envelope order was beyond the national capacity.”

These efforts were not in vain: the launch of the first credit card sparked an enduring shift in British banking, finance – and shopping habits. Nor was the initiative lost on then Chairman John Thomson, who praised the staff at the opening of the Barclaycard Centre in June 1966: “This has called for energy, patience, resource and occasional obloquy – and the distribution of vast quantities of paper and equipment. I can only say that Head Office never doubted that the managers and staff would meet this challenge with the utmost loyalty and skill; and Head Office was right.”

1967: Barclaycash, the world’s first automatic cash dispenser

While Barclays was busy developing an automatic cash dispenser in the mid-1960s, at least four similar devices were also under way around the world – so the title of ‘world first’ was far from guaranteed. With more and more people taking their money to the bank, innovation and adaptation were once again key to increasing efficiency and improving customer service.

So Barclays adapted. Collaborating with currency solutions company De La Rue Instruments, the bank developed six cash dispenser machines over the course of 18 months. Among the wide range of design criteria and security measures incorporated into these machines was a ‘personal code’ allocated to each customer, the forerunner to our modern PIN.

In 1967, the ‘Barclaycash’ machine was opened in Enfield, UK – earning the ‘world’s first’ stamp by an impossibly narrow margin. In front of an awestruck crowd, TV star Reg Varney withdrew £10 from the machine. Deputy Chairman at the time, Sir Thomas Bland, said: “It is a little bank in itself… Open for business 24 hours a day throughout the year, it is an exciting development and an earnest example of Barclays’ desire to come to terms with the needs of modern society.”

For years after that day, many people perpetuated the rumour that the revolutionary machine had in fact been operated by a man concealed inside it.

The opening of the world’s first automatic cash dispenser drew an awestruck crowd.

1987: Barclays Connect, the UK’s first debit card

Launching the UK’s first debit card in 1987 would help to take Barclays “into the 21st century”, said one senior leader.

Barclaycard’s launch in 1966 had helped boost efficiency – now the bank wanted to take this innovation further. How? With Barclays Connect, the UK’s first debit card, which would allow customers to access their funds electronically, process financial transactions and withdraw money from cash machines with ease.

Details of the card were leaked several months prior to its planned launch, but Barclays reacted with a tongue-in-cheek advertising campaign. This revolved around ‘letting the cat out of the bag’, featuring images of cats in paper bags that sported evidence of Barclays’ previous tech achievements.

As reported in Barclaynews, a monthly staff newspaper, the launch was a huge success. “We’re not the staid old bank we used to be,” said one senior leader at the event. “We have prided ourselves on being always at the forefront on banking service, and our latest innovation will take Barclays into the 21st century.”

It was clearly an innovation that customers delighted in: nine months after the launch of Barclays Connect, the bank had issued one million cards.