Wealth: it’s more than just a number

New report from Barclays and Cebr challenges nation to think differently about wealth

- The average Brit thinks you need over £1 million to be wealthy and a third think they would be happier if they earned more

- A new report from the Centre for Economics and Business Research (Cebr), commissioned by Barclays, proves your income isn’t the key to happiness

- In fact, a small increase in monthly savings has a much stronger effect on life satisfaction than a rise in income – and a greater impact than being happily married

- Barclays is challenging the UK’s perception of wealth and encouraging Brits to adopt a more Swedish approach, having teamed up with an expert to create their ‘Little Guide to Lagom’

‘Wealthy’ is a status that many aspire to but new research from Barclays and Cebr shows that wealth – at least in its traditional form - cannot buy happiness. Brits think you need over a million (£1,017,483) to be wealthy, yet the majority (54 per cent) of those who have achieved this level of personal wealth would not give themselves this title.

Furthermore, one in three (33 per cent) believe they would be happier if they earned more money. However, the route to happiness is in fact much simpler than your salary or the amount of money you have to your name.

The new report from Barclays and Cebr, ‘Living Lagom – challenging perceptions of wealth’, looks at how Brits could boost happiness and wellbeing by taking lessons from one of the world’s happiest countries, Sweden1, and focusing on little and often.

Cebr analysis2 shows that boosting the amount of money you save each month has a bigger impact on life satisfaction scores than an increase in income. In fact, the report findings show that if a person saved an additional 10 per cent of their monthly pay cheque, the likelihood of them reporting a high life satisfaction score increases.

What’s more, the impact of this increase in savings on life satisfaction is greater than that of being happily married, and the same as enjoying good health. In the long term, those who consistently have a savings account are over six per cent more likely to have a higher life satisfaction score.

Dirk Klee, CEO of Savings, Investments & Wealth Management at Barclays, says, “It’s easy to underestimate the benefits of saving or investing a regular amount each month. No matter what the amount, it will build to give you that peace of mind that you have something set aside for a rainy day, and move you closer to your goals.”

The report’s findings challenge people to stop thinking about wealth in terms of money and to start seeing their finances alongside all the other important factors and goals in their life – channelling the Swedish art of lagom, meaning “just the right amount”.

Linnea Dunne, author and lagom expert, says: “Lagom isn’t about extremes, it is about ‘just enough’ – and I believe applying the principles of lagom to all areas of your life can be hugely beneficial for your overall wellbeing and happiness. It is certainly clear from the new report from Barclays that, when it comes to our finances, living a little more lagom can genuinely improve our overall life satisfaction.”

Challenging the traditional concept of wealth

Currently, just seven per cent of the UK consider themselves to be ‘wealthy’, which is unsurprising when the report shows that the average Brit thinks you need £1 million to justify this title.

Dirk Klee continues, “Wealth is often seen as a bad word, something unachievable and for the lucky few. However, the reality is that money or ‘wealth’ is just a means to an end. It helps you to achieve a key life moment or personal ambition so, in fact, wealth should be seen as relative to your lifestyle and your goals.”

Taking a new approach to looking at wealth, focusing on achievable goals and balance rather than a particular figure, could help to improve happiness and life satisfaction.

Indeed, individuals who felt they were “living comfortably” or “doing alright” financially – regardless of income – were 11 per cent more likely to be mostly or completely satisfied with their life.

Generational attitudes to wealth

This approach to wealth is already more common than you might think, as analysis of different age groups shows that perceptions have already started to change and younger generations are learning that there is more to a rich existence than simply money. Those aged 18-34 set their definition of ‘wealth’ at £383,375 – significantly lower than the average £1 million – and one in 10 would say that they are wealthy.

The generational divide doesn’t end there either as just under half (49 per cent) of 18-34 year olds feel they would need to earn over 50 per cent more to feel wealthy whereas almost two thirds (63 per cent) of those over 55 feel this way.

So who are the happiest Brits?

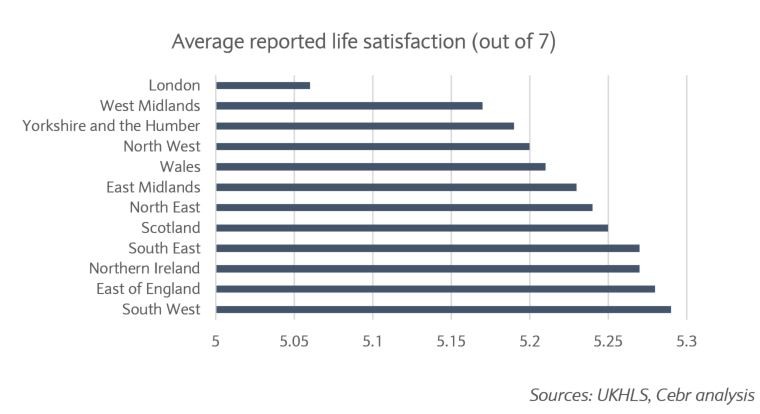

When we look at the UK, there are regional variations when it comes to life satisfaction.

Breaking this data down further, it is also possible to determine the happiest Brits by age group.

Age Group |

Where they live |

How much they save |

Average salary in region |

Under 35 |

Northern Ireland |

More than 10% of their income |

£22,018.30 |

Aged 35-54 |

North West |

More than 10% of their income |

£22,919.40 |

Aged 55+ |

North East |

8-10% of their income |

£22,191,50 |

Source: Cebr analysis

Interestingly, each generation’s happiest Brit comes from a region where the average salary is nearly half that of Londoners (£42,605.70), yet they prioritise saving a portion of the salary each month.

A quarter (24 per cent) of Brits3 admit that they never or rarely save but when looking at these findings and the happy Swedes, who collectively saved nearly a fifth (17 per cent) of their disposable income in 20184, there appears to be a clear case for prioritising it.

The little guide to living lagom

To help the nation apply the principles of moderation and balance to their finances, Barclays has teamed up with author and lagom expert, Linnea Dunne, to create a ‘Little Guide to Lagom’.

Within the guide, which is now available online, Linnea offers her top tips on living the lagom way with regards to your finances and beyond.

To find out more, read the Barclays Living Lagom report (PDF 2.02MB) and Linnea’s ‘Little Guide to Lagom (PDF 1.12MB)’.

- ENDS -

Notes to Editors

1 United Nations World Happiness Report 2019

2 Cebr econometric analyses on relationship between financial situation and life satisfaction using data from UK Household and Longitudinal Survey (UKHLS)

3 Independent consumer research of 4,000 UK adults carried out by Opinium in April 2019

4 Organisation for Economic Co-operation and Development (OECD)

About the research:

Barclays ‘Living Lagom’ report created with Cebr in May 2019 using econometric analyses of a variety of sources including the UK Household Longitudinal Survey and the ONS’ Living Costs and Food survey. This has been supplemented with analysis of independent consumer research of 4,000 UK adults carried out by Opinium in April 2019.