Digital beauty boom: new Barclays data reveals growing demand for buying beauty, skincare and fragrances on social media

- Demand for fragrance dupes – more affordable replicas of popular products – remains strong as Brits look to save money without compromising on quality

- Alternative high quality, affordable beauty products on the rise as Beauty Pie memberships continue to grow even through rising living costs

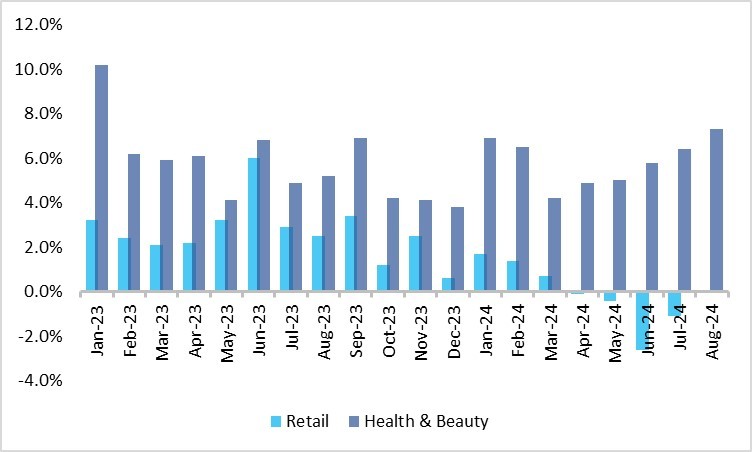

- Barclays Consumer Spend data shows that health and beauty has consistently outperformed broader non-essential spending since the start of 2023

New Barclays Consumer Spend data shows health and beauty has been the highest-performing category in an otherwise challenging retail sector since August 2023. While the rising cost of living has had little to no impact on overall consumer spending, cost-savvy shoppers are turning to health and beauty dupes to obtain better value-for-money – a trend also being encouraged on social media.

While rising living costs have resulted in consumer cutbacks across numerous categories, the demand for looking and feeling good means the beauty sector continues to be an outlier. In August, consumer spending on health and beauty was up 7.3 per cent year-on-year – the highest level since January 2023 (10.2 per cent), compared to retail as a whole, up 0.1 per cent, and non-essential spending, which was up 0.7 per cent overall.

In a bid to prioritise spending more on health and beauty, one in four (23 per cent) shoppers say they have been cutting back on clothing and accessories purchases, which is supported by Barclays transaction data showing clothing was down -1.7 per cent last month.

One potential reason for health and beauty outperforming broader non-essential spending is that, while these purchases are technically regarded as non-essential, recent Barclays Consumer Spend research data shows that nearly half (46 per cent) of consumers say they consider them as “essential” – a category which typically includes priority purchases such as groceries and childcare.

The most resilient products over the past three years – i.e. those where consumers say they have either increased or not changed their spending – are pharmaceuticals (68 per cent) hair-care (66 per cent), body-care (62 per cent) and fragrances (54 per cent).

Demand for dupes

Data shows that the demand for dupes – affordable products that mirror more expensive versions in quality, formula and/or appearance – remains strong. Nearly a third (32 per cent) of consumers say that due to the rising cost of living, they are buying dupes; in line with data from February 2023 (34 per cent)1.

Fragrances have emerged as the most sought-after health and beauty dupes, with 28 per cent of dupe-buyers admitting to spending on imitation scents. Make-up and beauty products are also popular with 24 per cent and 21 per cent of shoppers opting for these cost-effective alternatives.

That said, some still need convincing, as 18 per cent say they prefer to spend money on the original product rather than a dupe.

LipsTik-Tok effect

Social media has become a rising influence on consumer spending behaviours. Since January alone, the number of consumers watching de-influencing videos to find out what products are not worth buying has climbed by nearly 50 per cent (from 11 per cent2 to 17 per cent).

Positively for perfumists, the number of shoppers buying fragrances on social media has grown from 12 per cent to 17 per cent – the largest increase of any health and beauty product. Similarly, there is also a growing demand for beauty and skin-care products (24 per cent to 27 per cent), hair-care (14 per cent to 16 per cent), and health, fitness and wellness (14 per cent to 16 per cent)2.

As 22 per cent say they discover new beauty trends via social media, it’s no surprise that beauty and skin-care are amongst the most popular, with 27 per cent saying they have purchased these products on social media.

Encouragingly for bricks and mortar retailers, in-store spending remains a vital part of the shopping experience. The majority (56 per cent) of shoppers, say they prefer to buy health and beauty products that they’ve never used before, in-store. Consumers are however more comfortable making repeat purchases online (24 per cent), than they are first-time purchases (18 per cent).

Karen Johnson, Head of Retail at Barclays said: “Despite rising living costs and subdued growth across the rest of the retail sector, the UK’s beauty spending highlights a growing emphasis on self-care.

“It’s encouraging to see that overall beauty spending has been in growth year-on-year, with August showing the highest level of growth in the past 18 months. Our data shows that social media has proven to play a key role in influencing online purchases, a further demonstration of the rising commercial importance of these platforms.

“The health and beauty sector exemplifies continuous growth, likely driven by social media, particularly among younger generations. The key to a resilient retail model is examining these trends to better understand future purchasing behaviours.”

Sophie Jenkins, Global Marketing Director at Beauty Pie said: "With the rising cost of living, we are seeing our online memberships continuing to grow, as members are looking for higher quality and affordable products from the comfort of their home, making the beauty shopping experience more convenient and accessible than traditional retail businesses. This supports Barclays data findings that consumers are more comfortable making repeat purchases online.

“Given the recent economic impact on consumers, it’s important we remain a brand that our customers know will not compromise on quality. Typical beauty industry markups are ten times what the product costs to make, we believe our customers deserve better.”

Year-on-year growth in consumer spending – retail vs health and beauty

Spend Growth |

||

Date |

Retail |

Health and Beauty |

January 2023 |

3.2% |

10.2% |

February 2023 |

2.4% |

6.2% |

March 2023 |

2.1% |

5.9% |

April 2023 |

2.2% |

6.1% |

May 2023 |

3.2% |

4.1% |

June 2023 |

6.0% |

6.8% |

July 2023 |

2.9% |

4.9% |

August 2023 |

2.5% |

5.2% |

September 2023 |

3.4% |

6.9% |

October 2023 |

1.2% |

4.2% |

November 2023 |

2.5% |

4.1% |

December 2023 |

0.6% |

3.8% |

January 2024 |

1.7% |

6.9% |

February 2024 |

1.4% |

6.5% |

March 2024 |

0.7% |

4.2% |

April 2024 |

-0.1% |

4.9% |

May 2024 |

-0.4% |

5.0% |

June 2024 |

-2.6% |

5.8% |

July 2024 |

-1.1% |

6.4% |

August 2024 |

0.1% |

7.3% |

- ENDS-

Notes to Editors

Across its issuing and acquiring businesses, Barclays sees nearly 40 per cent of the nation’s credit and debit card transactions, which provides us with unique insight into UK consumer spending. This press release is based on consumer card spending data from Barclays’ issuing business – i.e. Barclays debit card and Barclaycard credit card transactions. The year-on-year growth mentioned in this press release is from ‘2022 Jun-2023 May’ vs ‘ 2023 Jun-2024 May’.

The Barclays Consumer Spend research in this press release was carried out between 9th-12th July 2024 by Opinium Research on behalf of Barclays, supplemented with additional research carried out between 6th – 9th August 2024. There were 2,000 respondents in each round of research, providing a representative sample of UK consumers by age, gender, region, and income group.

[1] Data captured for Barclays Consumer Spend reports between 17th – 21st February 2023

2 Data captured for Barclays Consumer Spend reports between 19th – 23rd January 2024

For more information, please contact Maya-Remedios Charlery at maya.charleryilawole@barclays.com

About Barclays

Our vision is to be the UK-centred leader in global finance. We are a diversified bank with comprehensive UK consumer, corporate and wealth and private banking franchises, a leading investment bank and a strong, specialist US consumer bank. Through these five divisions, we are working together for a better financial future for our customers, clients and communities.

For further information about Barclays, please visit our website home.barclays

About Barclays Market and Customer Insights

Barclays Market and Customer Insights helps businesses keep up to date with spending trends, monitors their market position and enhances their understanding of customer behaviour, based on actual customer spending. For further information, please email contact-MCI@barclays.com.