Our climate dashboard

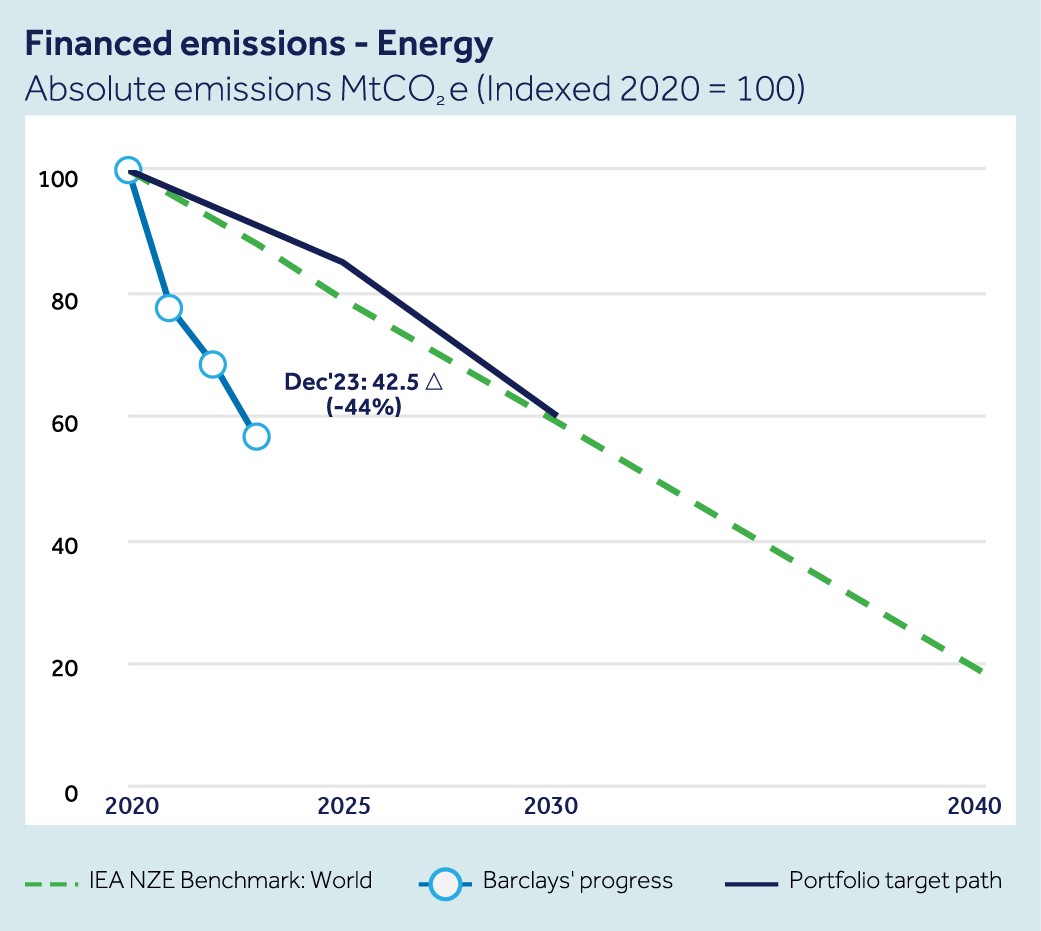

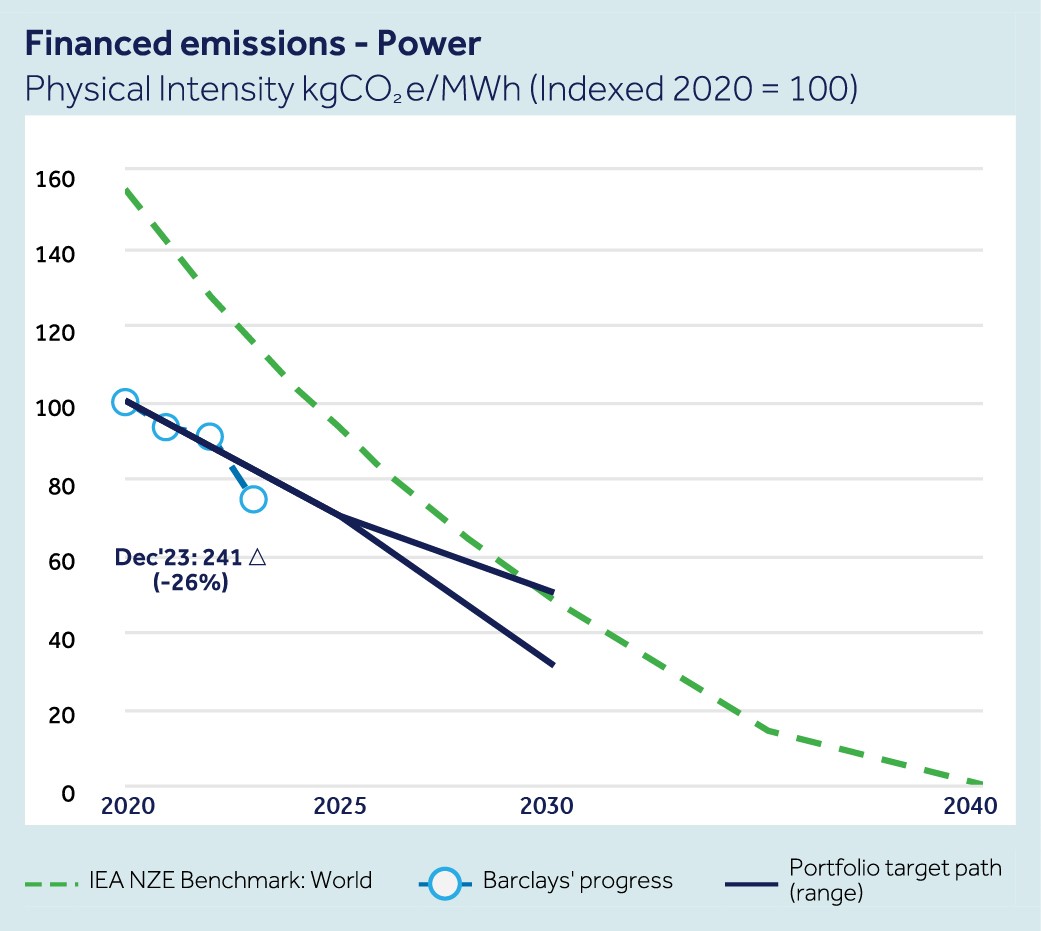

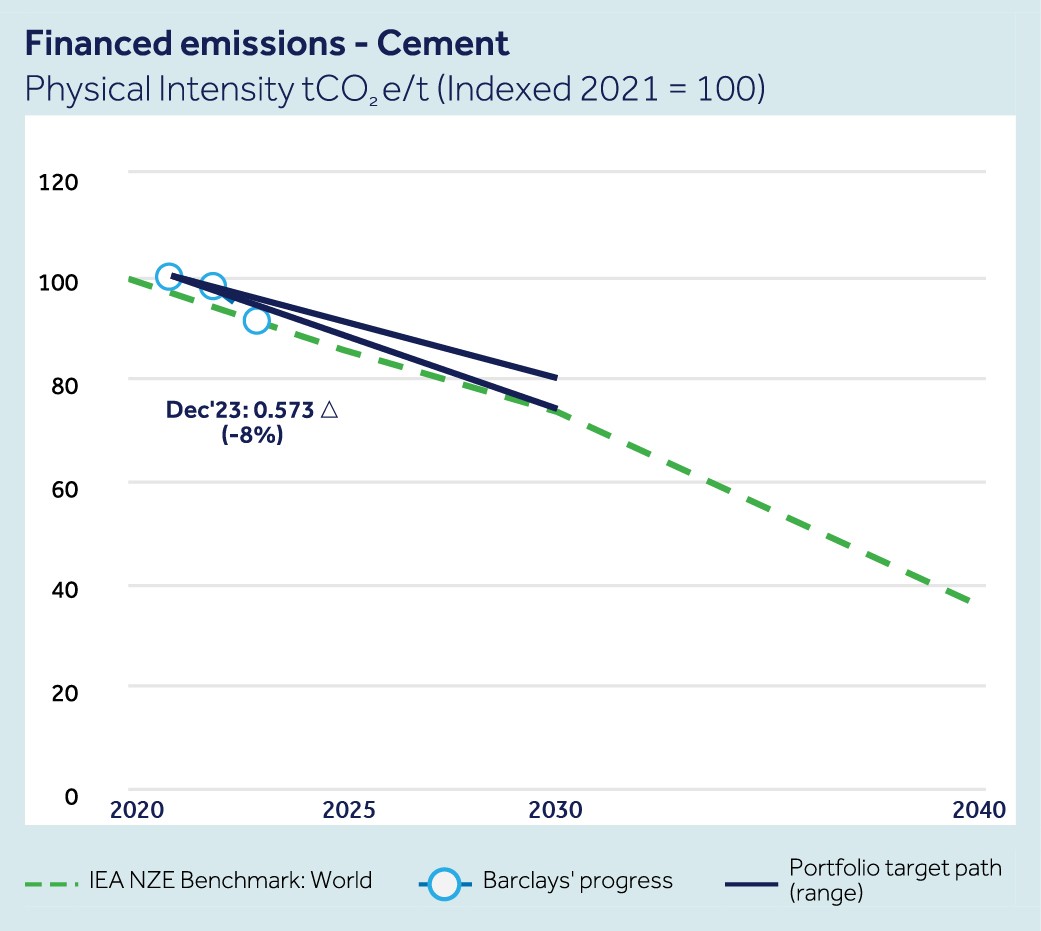

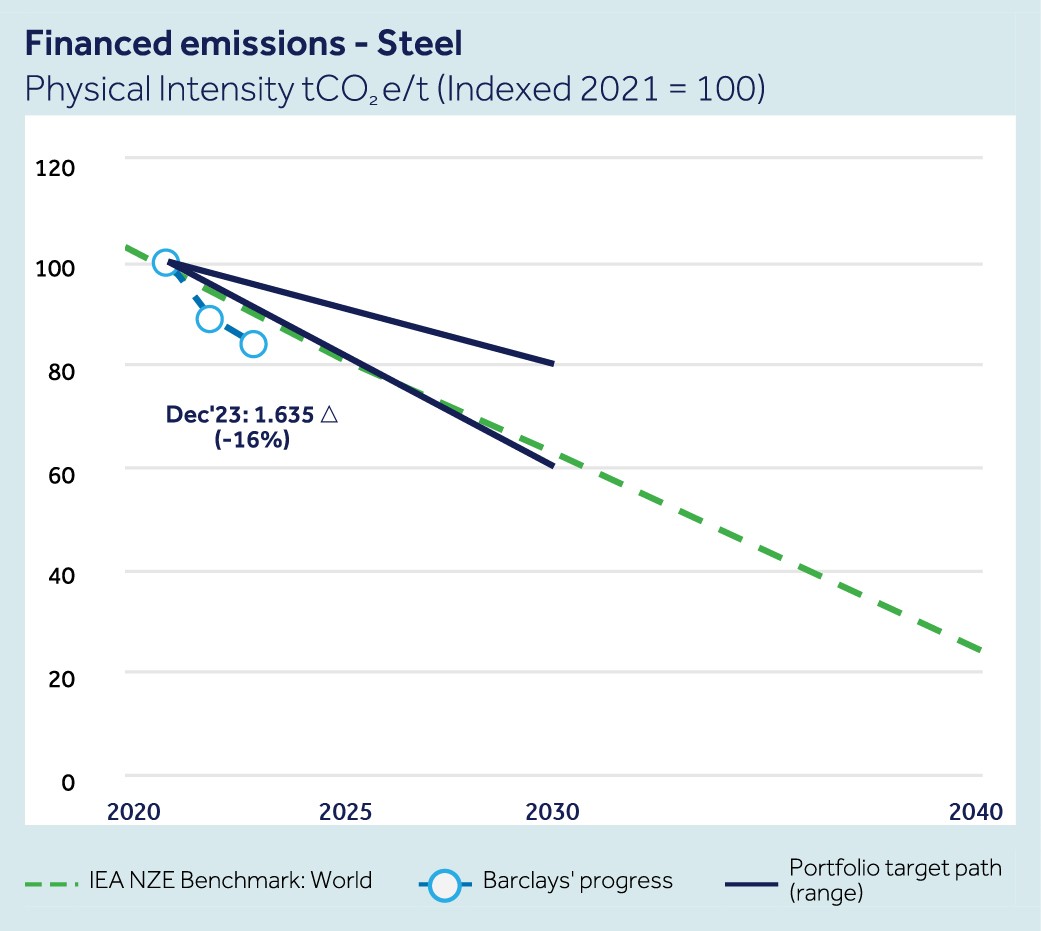

Our climate dashboard tracks our progress in reducing our financed emissions, measuring that progress against the goals of the Paris Agreement.

To determine the reduction of our financed emissions, we must first estimate the emissions that our clients produce. Next, we link those emissions to the financing provided. Finally, we aggregate those measurements into a portfolio-level metric, shown in blue in the charts below.

Our portfolio-level metric is then compared to an independently provided measurement, known as a ‘sectoral pathway’, shown in green below. For most sectors, this is the International Energy Agency’s Net-zero Emissions by 2050 (IEA NZE), a 1.5°C temperature rise scenario.

We have 2030 reduction targets that integrate IEA NZE for eight of the high-emitting sectors in our portfolio: Energy, Power, Cement, Steel, Automotive Manufacturing, Aviation, Agriculture and Commercial Real Estate.

We have also assessed our financed emissions for UK Residential Real Estate. The transition of the residential real estate sector to net zero depends mostly on external changes and public policy interventions. Without these external changes, Barclays cannot materially decrease the emissions intensity of its mortgage portfolio . Barclays identifies the 2030 emissions intensity 'convergence point' and measures our progress towards it. We are expanding the scope of our previously announced UK Residential Real Estate convergence point. The expanded scope, named to UK Housing sector, now includes Social Housing and Business Banking Real Estate portfolios, alongside the previous scope of Barclays UK residential and Private Banking mortgage portfolios.

For more information, see our 2023 Annual Report.

For Power, Cement, Steel and Automotive Manufacturing and Aviation, we have set emissions intensity targets using a target range. While we are clear on the reduction required to align with the IEA NZE2050 pathway – the higher emissions reduction in the range – we recognise there are dependencies outside our control that will determine how quickly our financed emissions intensity can be reduced in these sectors. The lower emissions reduction in the range reflects our view of the sector, client pathways and commitments at the time of setting the target.

We seek to achieve the higher emissions reduction, consistent with our net zero ambition, but achieving it will depend on external factors. Our climate dashboard will be updated in line with our annual reporting in the first quarter of each year. Our Annual Report also includes the information we publish under the guidelines of the Taskforce on Climate-Related Financial Disclosures.

More information on our approach, methodology and data is available in our Barclays Financed Emissions Methodology and 2023 Annual Report