Barclays business can be traced back to two Quakers called John Freame and Thomas Gould, who established themselves as goldsmith bankers in Lombard Street in the City of London in 1690. Their business flourished, helped in no small part by its Quaker connections. They financed Quaker traders in the new colonies in America and the Caribbean, they helped to finance the Pennsylvania Land Company, and they were actively involved in Quaker-dominated companies like the London Lead Company and the Welsh Copper Company.

The latter produced silver as a by-product, which Freame and Gould sold to the Royal Mint. They were also the closest thing the Quakers had to an official banker, holding the Society Of Friends' central funds (known as the national stock). In 1695, this amounted to £1,100.

Beyond his bank, John Freame was a very well-respected and influential character. He served as clerk to the Yearly Meeting (the Quakers' annual gathering attended by local representatives from all over the country), and published a book called 'Scripture Instruction' which was used in Quaker schools. He also campaigned for greater toleration for the Quakers, achieving the right to make an affirmation rather than swear an oath, and the right to be prosecuted before magistrates rather than in the church courts.

In 1728, Freame’s son, Joseph, became a partner in the bank, and John Freame began a gradual process of retirement. James Barclay joined the firm in 1733, having married Freame’s daughter, Sarah. James was the son of David Barclay by his first wife, Ann. Following the death of Ann, David Barclay married Freame’s elder daughter Priscilla in 1723. This rather complicated state of affairs meant that James Barclay's stepmother was also his sister-in-law, but is quite typical of the way the Quakers ran their lives and businesses. Family, religious and business ties were inextricably linked.

James Barclay had a strong business and Quaker background. His grandfather, Robert Barclay, was known as 'The Apologist' because he wrote a book explaining the Quakers' beliefs, entitled, 'Apology For The True Christian Divinity'

Although David Barclay Senior did not become a partner in the bank, his sons by his second wife (and, therefore, John Freame’s grandsons), David Barclay the younger and John Barclay did. By this time, the partners were amassing fortunes which may have seemed at odds with the Quaker principles of simple and plain living, but it is important to remember that a Quaker who went bankrupt was disowned by the Society.

While the fear of bankruptcy may have spurred the Barclays on to ever greater profitability, they still had not lost sight of other Quaker virtues. David Barclay the younger, who became a partner in the bank in 1776, was a very active Quaker.

A keen supporter of the emancipation campaigner Wiilliam Willberforce, he used his influence to persuade other Quakers to take a stronger stand for the abolition of slavery. Later, David Barclay found himself the owner of a slave plantation in Jamaica in settlement of a debt. His decision to free the slaves and transport them to Philadelphia cost him £3,000.

Barclay was also well-respected in the wider community. A close friend of Benjamin Franklin, he attempted to mediate between the rebellious colonists in America and the British government in 1774 and 1775. He must have suspected the worst, however, because he had been redirecting his own business interests away from North America for some time. It would appear that even the span of the Atlantic Ocean could not disrupt Quaker business connections - the large number of Friends who settled in America made sure that their British cousins were kept well informed.

Beyond London

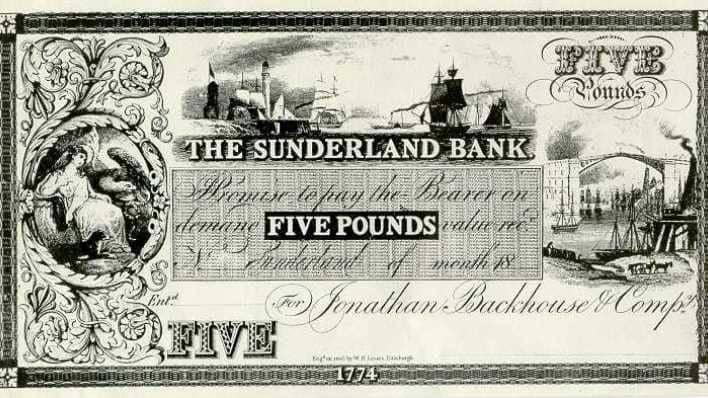

While banks in London were thriving, banking in the rest of England was only just beginning. One of the earliest 'country banks' in Barclays history is that established in 1744 by Samuel Alexander in Needham Market in Suffolk. Alexander was a Quaker merchant with interests in the iron and corn trade.

In what was to become a regular pattern in rural areas and market towns all over England, Alexander was perceived by his customers to be a trustworthy, reliable and relatively wealthy man, so they felt happy entrusting their money to his care. His faith undoubtedly played an important part in forming this opinion, and it also meant that he had access to the Friends' business network, so was able to call upon the Barclays to act as his London agent.

Alexander's went on to merge with Gurney’s, the biggest country bank to take part in the 1896 amalgamation. The Gurney business began with the Norwich and Norfolk bank, opened by Quaker brothers, John and Henry Gurney on 13 May 1775. They had made their money as worsted, linen and yarn merchants.

As banking became more profitable than cloth, their business expanded and they established partnerships in Great Yarmouth, Kings Lynn, Wisbech, Fakenham, Ipswich, Colchester and Halesworth. By 1838, the Gurneys were described as 'exercising an influence and a power inferior to that of no banking establishment in Great Britain - that of the Bank of England alone excepted'.

Like many successful Quakers, some of the Gurneys found it difficult to reconcile their faith with their wealth. Joseph John Gurney chose to become a ‘plain Friend’, dedicating his life to his bank, his religion and good causes. Like his sister, Elizabeth Fry, he campaigned for prison reform.

He also campaigned against slavery, and in 1837 went on a three year ministering tour of the West Indies and America, giving away one third of his share of the Bank's profits for the duration. He was a renowned Quaker author - his 1824 work, 'Observations on the Religious Peculiarities of the Society Of Friends'; was reprinted many times. His attitude is exemplified by his statement:

'I suppose my leading outward object in life may be said to be the bank. While i am a banker the bank must be attended to. It is obviously the religious duty of a trustee to so large an amount to be diligent in watching his trust.'

The Gurney name is also famous for its involvement in Overend, Gurney and Company, a firm of London bill brokers which failed spectacularly in 1866, prompting a financial crisis. Although members of the Gurney family were implicated and affected by the failure, the Gurneys’ East Anglian banks came through remarkably unscathed, due mainly to quick thinking and shrewd judgement by their Barclay cousins.

By injecting new capital and new partners into the Norwich Bank, they effectively distanced it from the bill broking business just one month before it crashed. While the very public failure of one Quaker business was highly regrettable, it had clearly been beyond saving, and ruthless action had been needed to prevent other businesses going down with Overend, Gurney and Company.