Making memories: the rise of the experience economy

26 June 2024

As Taylor Swift’s record-breaking Eras Tour finally reaches the UK, we explore insights from Barclays Consumer Spend research that show why the event reflects a broader shift in how consumers view experiences – and how businesses can meet this demand to maximise their profits this summer.

As summer arrives in the UK, so too does Taylor Swift’s ‘Eras Tour’. The excitement is palpable – and not just for those lucky enough to attend the concerts themselves.

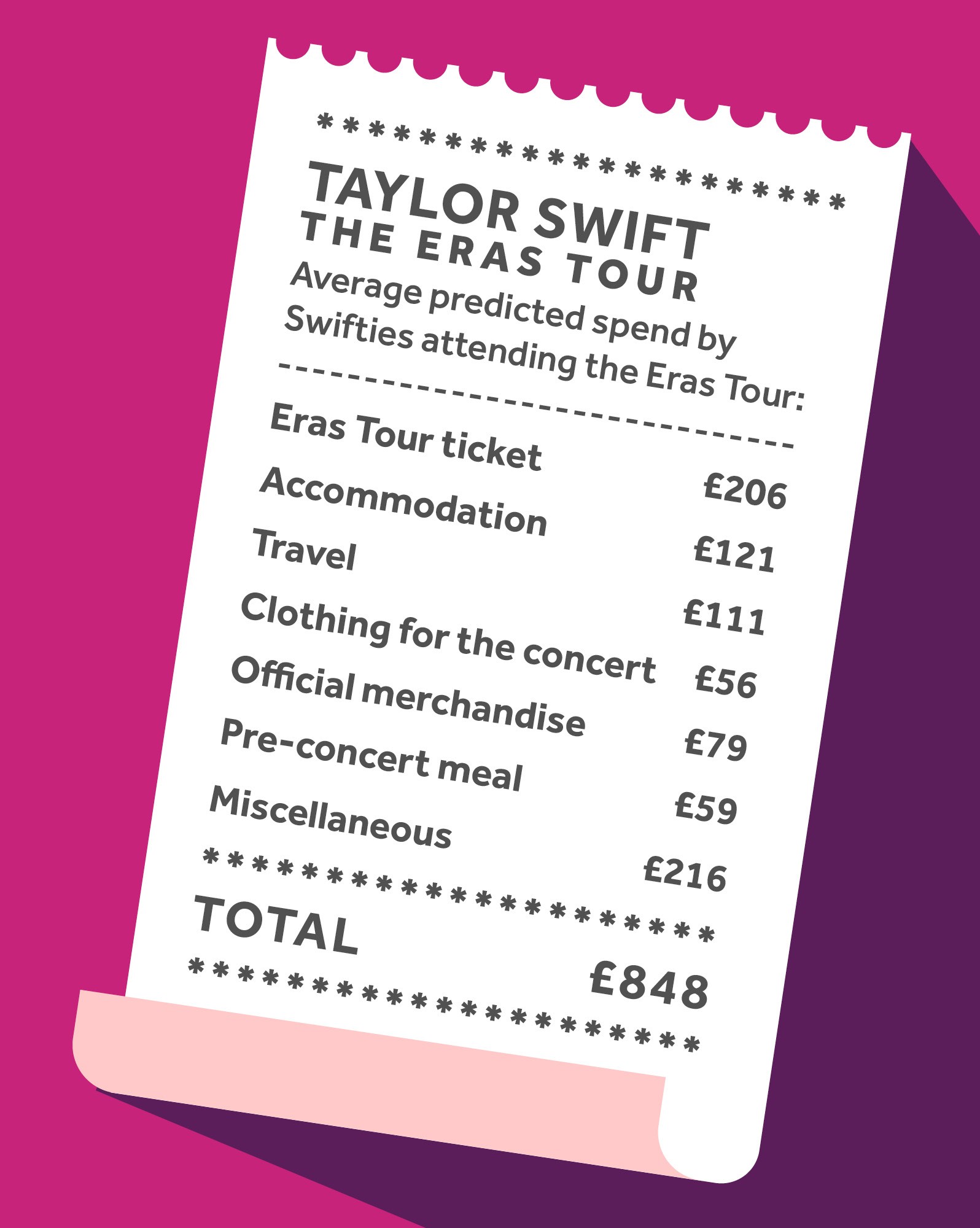

The analysis of the boost to businesses that accompanies the singer has been dubbed ‘Swiftonomics’. Insights from Barclays Consumer Spend research suggest that the 1.2 million fans attending the tour could spend a whopping £848 each on tickets, travel, accommodation, outfits and other expenses. From enjoying pre-concert meals in restaurants to splashing out on official merchandise at the tour stops, Barclays predicts that consumers will spend a total of just under £1 billion (£997 million).

For Eras Tour ticketholders, every pound they spend is an investment in the memories they’ll create.

In fact, when compared with existing figures shared by other organisations, the bank’s research shows that this anticipated spend on the Eras Tour is more than 12 times the average cost of a UK night out, more than twice the amount people pay to attend UK-based weddings – and even higher than the cost of a UK-based stag or hen do.

Making memories (and friendship bracelets)

These figures may seem astonishing. However, fans know that they will be making more than just friendship bracelets when they buy a ticket to see Swift. “For Eras Tour ticketholders, every pound they spend is an investment in the memories they’ll create,” says Dr Peter Brooks, Chief Behavioural Scientist at Barclays. This mindset reflects a wider shift in the UK towards the experience economy – where consumers prioritise spending on events and experiences over goods.

“Fans are increasingly going all-out on experiences that resonate on a personal level,” says Tom Corbett, Head of Group Sponsorship at Barclays. This “turns every concert into a potential holiday, every ticket into a cherished memory and every event into an opportunity to splash out on new outfits, food and merchandise”.

Brooks agrees: “When it comes to cultural icons like Taylor Swift – like we saw with Elvis and Beatlemania in the 50s and 60s – supporters have such a strong connection to the artist and the rest of the fandom that the desire to spend becomes even more powerful.”

Of course, the draw of the experience economy extends beyond Swifties. Research commissioned by the bank from the Centre for Economics and Business Research found that businesses involved in the experience economy contribute an estimated £134 billion to the wider UK economy. This is expected to grow by an average of 2.6% between now and 2027 – surpassing the equivalent figure for the UK economy as a whole (1.6%).

According to 2024 research from Barclays, which surveyed 2,000 UK adults, one in four UK consumers plan to spend more on memorable experiences this summer compared to their spending last year. This figure is even higher (32%) for those aged 18–34.

While 44% of consumers are planning to spend the same amount as last year, only 15% say they will spend less. But what’s driving this boost?

There’s growing evidence that spending on experiences boosts happiness and wellbeing more so than purchasing physical items.

Brooks believes it’s because consumers recognise there is real value in experiences. “There’s growing evidence that spending on experiences boosts happiness and wellbeing more so than purchasing physical items,” he notes. Of those planning to spend more, 38% report that it is because they want to make the most out of summer, while 31% wish to invest in quality times with friends and family.

The rising cost of living has certainly had an impact, too, with just under a third indicating they will spend more as a result of increased prices. But, despite these challenges, many consumers still want to invest in events. In fact, nine in ten hospitality, leisure and retail decision-makers report that consumers are still happy to spend on memorable experiences, even when money is tight.

Experiences and expectations

So, where will consumers be spending their event budgets? Music events such as the Eras Tour clearly have considerable appeal. A quarter of UK adults surveyed say that a performance by a specific band or music artist is the type of entertainment they can experience the most without getting bored – nearly double the proportions recorded for other experiences such as TV programmes, musicals or films. A fifth of consumers credit live shows with being longer-lasting than other entertainment formats, and 17% report a stronger emotional connection to this type of experience.

But for Brits this summer, there’s another common thread – trips away from home. ‘Holidays in the UK’ and ‘beach or seaside trips’ both came out on top in a Barclays survey investigating summer spending plans with 77% of surveyed consumers planning each of these. Rounding out the most popular options are ‘community events’ at 73%, ‘outdoor activities’ at 71% and ‘holidays abroad’ at 68%.

Regarding overall event spending, one-third prefer to spend on experiences that they can share with family or friends. Also telling is that 13% of consumers report that they feel less guilt when spending on experiences, with 16% also preferring to purchase experiences as gifts over material possessions. In fact, 63% say they would rather tell people about something they experienced than something they bought.

“Whether it’s a once-in-a-lifetime holiday or a birthday celebration with friends, we want our experiences to be bigger and better than ever before, and our standards have never been higher,” says Rich Robinson, Head of Hospitality and Leisure at Barclays. About a fifth of Brits surveyed say they expect more from experiences this year compared to previous years, while 52% say their expectations are the same.

As people carefully consider their spending plans for the summer, this is an important moment for businesses to work out how they can reach customers.

Connecting with consumers

“Brits are increasingly swapping shopping bags for shared moments, and experiences now make a heavyweight contribution to the UK economy as a whole,” notes Robinson. “This trend is set to gather momentum, with retail, hospitality and leisure businesses ready to capitalise on this commercial opportunity.” Business decision-makers in these sectors are well aware that tapping into the experience economy could make a difference to their profits – and many are joining consumers in making the most of the value that experiences can offer.

Bowling brand Tenpin is one company that has been continually adapting over the years to take advantage of the growing focus on experiences. The team has worked to enhance its 54 locations across the UK – whether that has meant updating lighting and sound systems, or introducing table-top ordering and more comfortable seating.

“Our experience has shown us that when trends shift, we don’t need to rebuild the walls, we simply need to repurpose the space we’ve created,” says its CEO Graham Blackwell. “The bowling alley was once viewed as a cold environment. We’ve created a warm, leisurely place where people feel welcome, want to stay and enjoy refreshments with a range of activities for the whole family. If I could turn all of our units into a home away from home, that would be amazing.”

Barclays research indicates that 93% of decision-makers expect the summer’s sporting and cultural events to have a positive impact on their businesses, with 90% reporting that consumer demand for memorable experiences is growing faster than demand for physical products. In addition, 92% also agree that sports and cultural events in the UK help create opportunities for them to attract new customers, and 90% report that demand for their products or services rises during these occasions.

The Barclays research also found that 31% of the surveyed decision-makers have invested in staff training, 29% have increased their physical presence at event venues and 20% are looking to extend operating hours to capitalise on increasing footfall from events. Businesses have also found ways to adapt their offering if necessary – with 27% saying their company has launched new products that provide memorable experiences and 22% planning to pivot their business model to offer more memorable experiences that help them stand out from competitors.

To stay ahead of the curve, retailers, hospitality and leisure businesses will need to continue to innovate, ensuring their products and offerings are not just a one-hit wonder but are special enough to keep crowds coming back for more.

With or without Eras Tour tickets, it looks like the UK is ready to embrace a host of experiences this summer – and businesses need to be ready for it.