British entrepreneurs enjoy five-year high

Britain enjoyed a five-year high in opportunities for entrepreneurs leading up to the EU referendum in June, but that progress is at risk of being set back by current market uncertainty.

The Barclays Entrepreneurs Index assesses the strength of the UK’s entrepreneurial environment and found that overall UK performance is up 10% since 2011. But a lack of new scale-up businesses, as well as market uncertainty, could harm the nation's growth prospects.

Start-up activity has dropped by nearly 4% up to the end of 2015, with the UK producing fewer businesses with ambitions of scaling up.

There has been an increase in the number of business exits with a 19% rise in the number of mergers and acquisitions (M&A) of companies less than five-years-old. There were a record number of deals from December 2015 to June 2016 (up 33%).

The jump was driven by the UK services sector, which accounted for 23% of all deals that took place, followed by financial services firms (10%).

However, there was also a steep drop in IPO activity (down 36%), which indicates a lack of confidence among companies to expand, as well as increasing market volatility.

Akshaya Bhargava, Chief Executive of Wealth, Entrepreneurs and Business Banking at Barclays, said: “This year’s Entrepreneurs Index shows that before the EU Referendum, regulations and conditions for entrepreneurs had improved, making it easier to start a business and contributed to a rise in M&A.

“Until the outcome is fully known, it’s vital that we do everything in our power to deliver a strong environment to sustain UK entrepreneurial growth.”

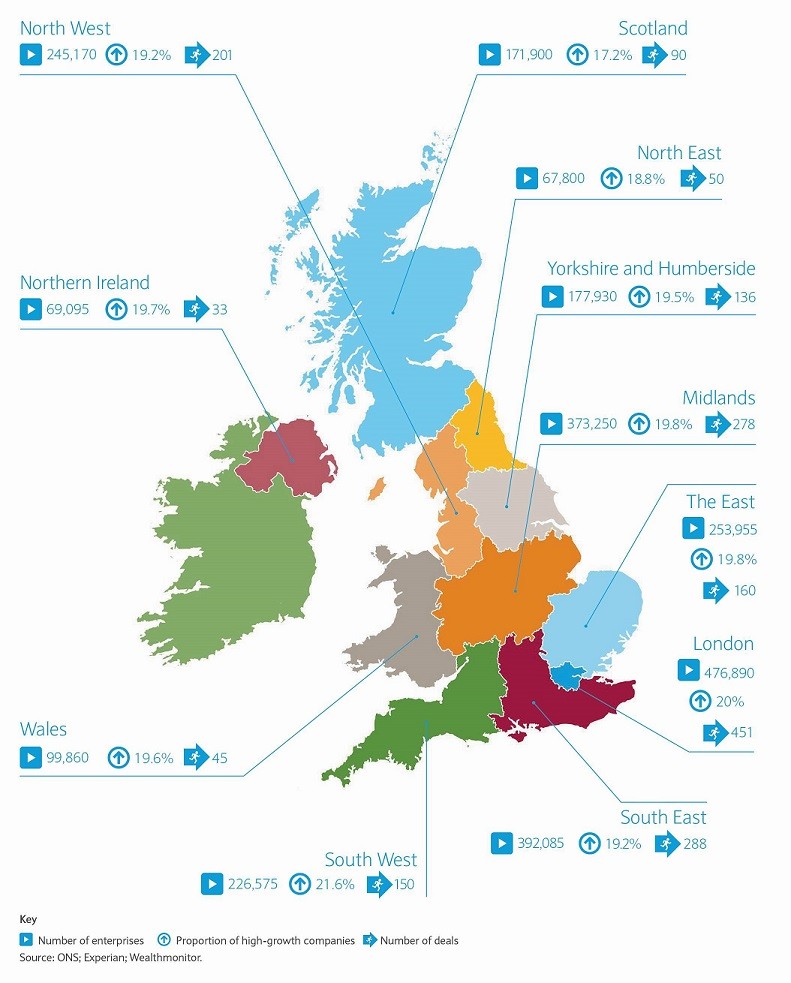

UK and Northern Ireland regional enterprise activity