Innovation

Barclays celebrates five years of fintech

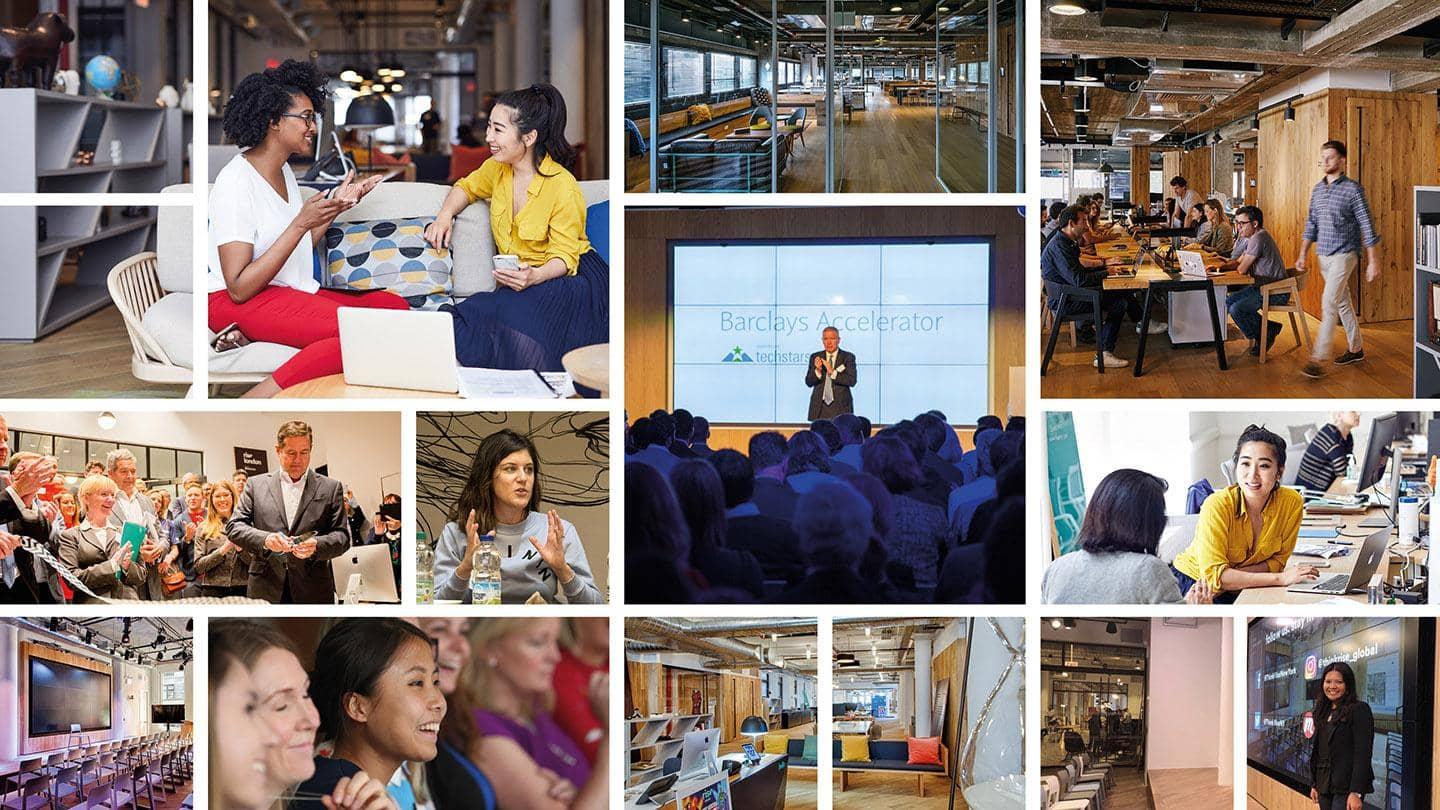

With a vision to facilitate innovation in financial services and a desire to nurture the best and brightest talent on the scene – Rise has grown from the seed of an idea into a leading global network. As the platform celebrates its fifth anniversary, we look back at some of the key moments in its journey to becoming “the experts the fintech world needs to keep innovating”.

Rise London, Barclays’ first flagship fintech HQ, is now one of four dotted around the globe – from Mumbai to New York to Tel Aviv. Since 2015, the initial London-based team of less than 10 has developed into an international network of innovators, and the success of its talent-sourcing Barclays Accelerator, powered by Techstars, has positioned the bank at the very forefront of the startup scene. We take a step back in time and share some of the highlights of building a global platform for cutting-edge fintechs.

Year one: Rise is born

The year is 2015. Fintech startups are booming; blockchain is developing at pace and payment technology is changing the way the world handles its finances.

Rise, Barclays’ global network of fintechs, is born in this climate of rapid innovation. Designed to fuse the agility of the fintech scene with the reach and expertise of Barclays’ global operations, its pilot team begins a quest to accelerate growth within the financial industry by supporting fintech from a new hub in Whitechapel, London. “From self-confessed technology fanatics and self-motivated startups, to the best and brightest thinkers and doers from around the world, we encouraged everyone to connect with us, join with us and grow, to create the future of financial services,” remembers Magdalena Krön, Rise Global FinTech Platform Director at Barclays.

We’re always at the forefront of industry trends, setting new boundaries, pushing innovation further, testing, learning

Rise Global FinTech Platform Director at Barclays

The launch of the flagship Barclays Accelerator – in partnership with Techstars – sees Rise identifying and nurturing the newest and brightest tech talent on the block and widening its network of innovators. The 90-day programme helps promising startups to scale, bringing their products and solutions to fruition at pace – with the majority going on to partner with Barclays longer term. The 170 businesses that would eventually come through the programme are now estimated to be worth more than $1.4bn.

Year two: sharing is caring

The success of Rise London leads to the opening of more physical hubs including New York, Tel Aviv and Mumbai – all leading financial centres with thriving tech scenes. By tapping into completely different markets and gaining insight into new customer trends, Rise identifies a need for an alternative approach to fintech growth – and Open Innovation becomes the new modus operandi.

By championing global collaboration and the sharing of ideas rather than allowing knowledge silos, Krön says innovators at Rise felt that “together, we could empower the world”. She estimates that, as a result, products and innovations are not only better tailored to customer needs, but are developed three times quicker and at a fraction of the cost.

Year three: leaders in their field

With the first two years focussed on helping startups, Rise begins to scale up and amplify its status as a major thought leader. Through partnerships with influencers and leading figures in the fintech world, as well as the launch of thinkrise.com (later rise.barclays) and a dedicated podcast covering current topics, the Rise network carves out its own space to share the latest industry developments. It soon begins to be seen as a reliable source and “the voice to listen to for all things fintech”, says Krön.

From self-confessed technology fanatics and self-motivated startups, we encouraged everyone to connect with us, join with us and grow, to create the future of financial services

Rise Global FinTech Platform Director at Barclays

Meanwhile a new series of hugely popular hackathon events – one or two-day sessions that challenge innovators to find creative solutions to industry-wide problems – showcase talent and celebrate the value of fintech, all while producing cutting-edge ideas that have the potential to save the financial services billions if put into action.

Year four: supporting female talent

The team at Rise utilise its in-house expertise and reputation to make positive social change, with issues around diversity and inclusion in fintech and the funding gender gap at the top of the agenda.

A collaboration between Barclays and investment platform Anthemis leads to the establishment of the Female Innovators Lab – a New York-based studio dedicated both to cultivating entrepreneurial talent in women from all sides of financial services and to closing the fundraising gender gap. By identifying female founders at the earliest stage of their journey, and providing them with the initial investment, resources and mentorship required to bring a business concept to market, female innovators are given opportunities to grow their business ideas.

The innovation mindset that characterises Rise filters down through the bank, with Barclays colleagues benefiting from secondments and opportunities to spend time at the hubs where they can get to grips with innovative thinking – and implement this learning across the bank.

Year five: dotting the i’s and crossing the three t’s

2020 ushered in a new decade – and a new mantra: talent, technology and trends. “Over the last five years, we’ve become the experts the fintech world needs to keep innovating. We’re sophisticated in the way we inspire businesses, our colleagues and each other, to do more, be better and innovate harder,” says Krön. With the expansion of Rise New York – now the network’s largest site – comes the opportunity for over 200 startups to thrive. Rise is embracing a new digital life and the 2020 London Accelerator Demo Day, delivered online due to the coronavirus pandemic, saw a record number of registrations, while the surge in e-commerce has proved the need for platforms to be as simple and robust as possible.

For Krön, it’s only the beginning: “We’re always at the forefront of industry trends, setting new boundaries, pushing innovation further, testing, learning.”