Innovation

“Get the culture right and everything else works”

04 August 2021

The 2021 New York class of the Barclays Accelerator, powered by Techstars, recently celebrated its graduation. To mark this occasion, Barclays’ CEO of Consumer Banking and Payments, Ashok Vaswani, got together with angel investor, author, serial entrepreneur and Co-Founder and CEO of Bionic, David Kidder to discuss learning from startups, listening to customers – and how a ‘new to big’ mindset can help large companies innovate and achieve meaningful growth. Here are some highlights from their conversation.

Ashok Vaswani: David, you work very closely with large organisations right around the world. What stops them from innovating effectively?

David Kidder: I often find that while the CEO may be saying: “Let’s be innovative and grow,” when you look within the organisation, the story of what’s happening doesn’t align with that vision, and there can be different versions of the truth – depending on who is being asked. That lack of truth is at the heart of the problem.

Ashok: Yes, exactly. For me, you can’t just sit at the top of the house and tell people: “Innovate, innovate, innovate.” It’s about trying to change the culture and everything from the way people think to the way they are rewarded. First and foremost, it’s a cultural and a mindset issue. Get the culture right and everything else works. What other problems do you tend to see?

David: Most large organisations have lost the skill of discovery. They have systems to take out risk and grow incrementally. I describe this approach as ‘big to bigger’. What’s needed is a shift to a ‘new to big’ approach, where the organisation identifies and invests in new ways to grow.

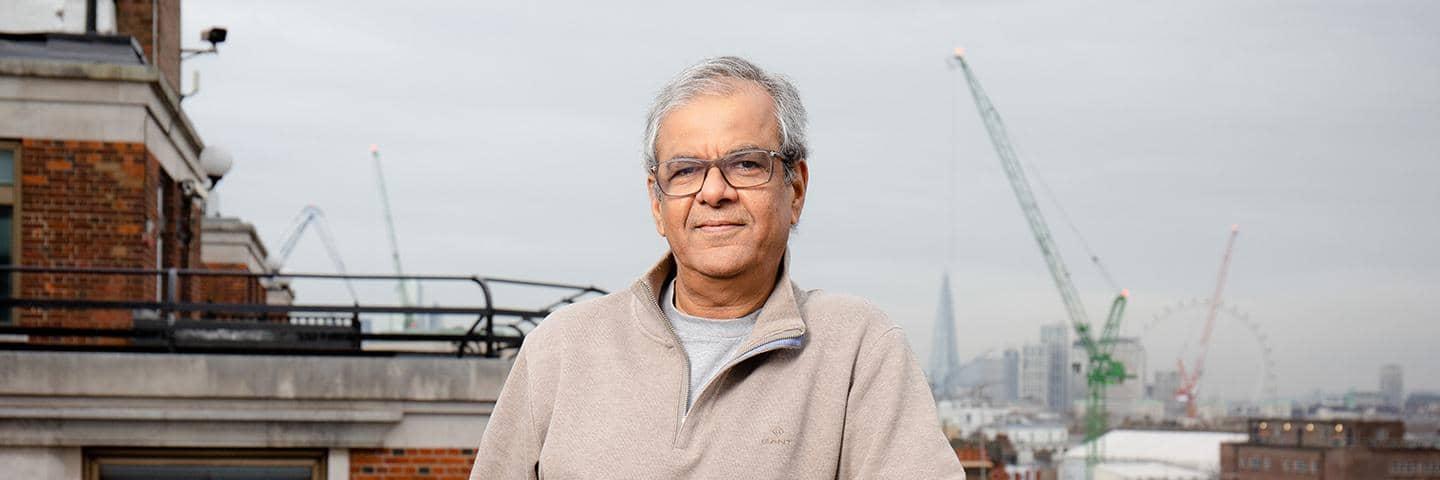

A technology solution in search of a customer problem is a fatal approach.

Co-Founder and CEO, Bionic

David Kidder says organisations need to consider a ‘new to big’ approach.

Ashok: The way we try to tackle that is to really focus on the new ideas that meet new needs that will fuel growth for the bank. And we need to spend time talking to people outside the organisation, like you, because that’s how we really find out what’s going on – and get great ideas. We challenge our teams to think like fintech startups – we want them to be intrapreneurial, share ideas and collaborate.

Thinking ‘new to big’

Ashok: As you write in your book, growth through innovation has to be about addressing your customer’s problem, rather than solving your own problem. In Barclays’ case, we’ve kept changing and we’ll continue to change. And right now, the change is all about the adoption of technology. What’s not changed is our focus on the customer – getting it right for the customer, and meeting their needs in an increasingly sophisticated way.

David: One big lesson I’ve found from working with big organisations is that a technology solution in search of a customer problem is a fatal approach. 90% of the investments corporates make are about fixing themselves and have nothing to do with the customer problem. One thing I’ve learned as an angel investor is you never invest in an entrepreneur who loves their idea – only in people obsessed with a problem.

Ashok: Exactly. You have to listen to what your customers are saying! Listen, listen, listen. Every time we’ve done something where the journey has been fantastic, the customer has taken it up without us even needing to market it. Every time the customer doesn’t take it up, we know there is something we’ve done wrong and, as a team, we need to regroup and rethink the journey.

David: Yes, and there are multiple ways of focusing on tackling whatever customer problem might present itself. An internal business unit may need to show results in the next 12-18 months, while a disruptive group from outside, like an innovation accelerator or startup partner, may be working with a completely different set of permissions. The key is to solve the problem in both the short and long term.

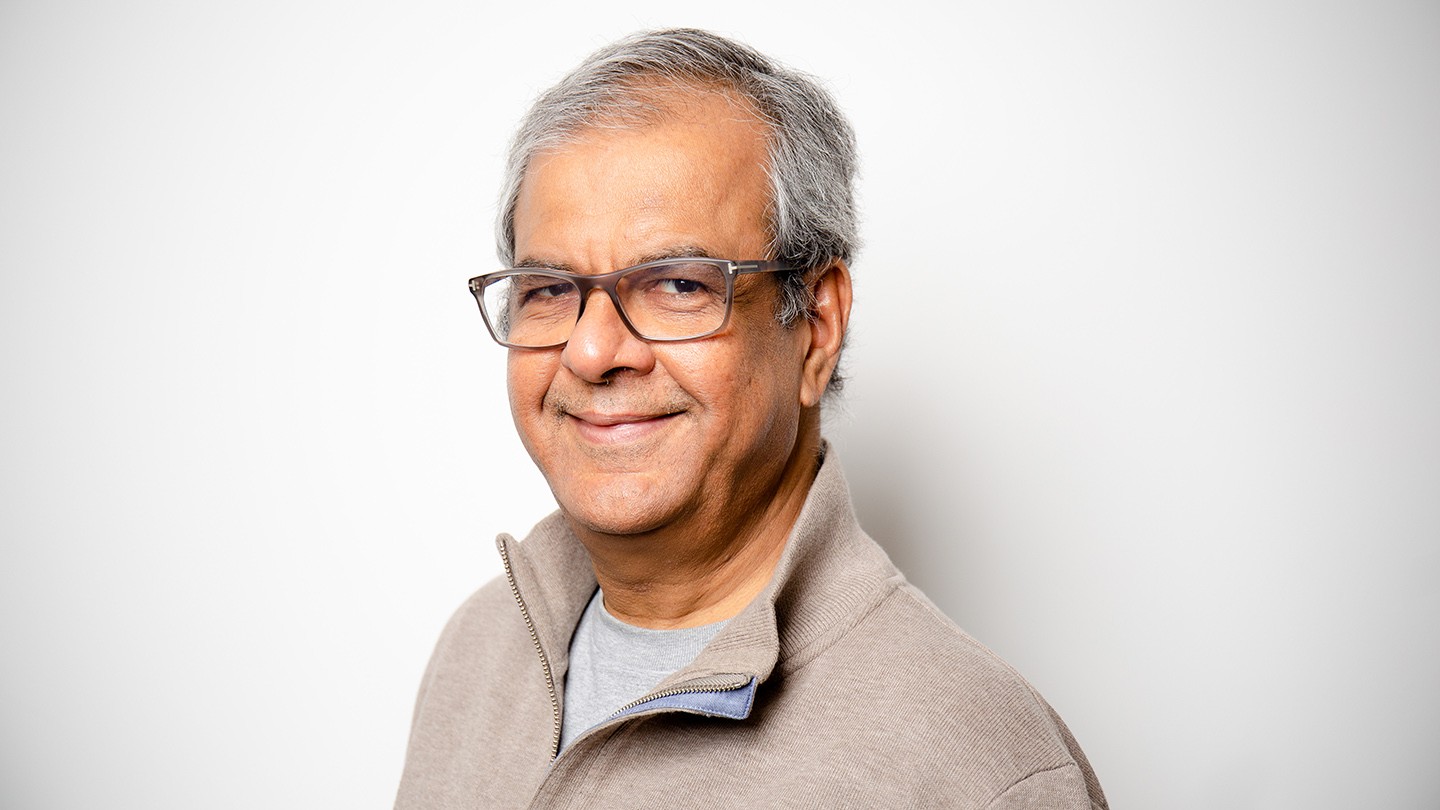

Ashok Vaswani says it’s vital for colleagues at companies to have “frank and honest conversations”.

We explore fintech innovations early on so that we can help to shape their development and together create the future of financial services.

CEO Consumer Banking and Payments, Barclays

Ashok: I agree – we all have to think about disruption and the ability to move at speed. At the same time, an organisation like ours carries all the controls, responsibility and public trust of a highly regulated business. So, you have to start by recognising that you can’t do everything in-house. You have to work out the areas you’ll own and be responsible for, and where it’s better to partner with someone else.

Working with emerging technology brands and innovators through initiatives like Rise, Barclays’ global fintech platform, helps us identify opportunities and trends in the wider commercial and digital landscape, so that we’re set for the future. We explore fintech innovations early on so that we can help to shape their development and together create the future of financial services.

What we provide is scale, which every startup would like to have. And we know about all the challenges of dealing with regulators, society, public opinion – we know about the growing pains.

“Bad-idea killing machines”

David: One problem we see is that an organisation can try lots of things, new projects, products and technologies, but often they don’t die when they should. You need a system that is a ‘bad-idea killing machine’. Chief financial officers are very forward focused, but they need to have confidence that the organisation’s internal systems and cultures will not support initiatives that should be terminated.

Ashok: You’ve got to learn, you’ve got to try and experiment, because usually you don’t get it right the first time. We make mistakes, but we learn and we move forward. But the thing never to do is fall in love with your thoughts. Frank and honest conversations are what help us get to the place of dropping those ideas that shouldn’t be progressed.

David: Yes, and businesses need to seek discomfort. They make their money from the ideas with the greatest disagreement. When we have consensus, we’re in trouble – we don’t learn anything if everybody knows the same thing. You have to create and foster a culture where failure is celebrated, so that killing a bad idea does not discourage a team from continuing their experimentation.

Ashok: That’s why, as well as being the right thing to do, having diverse teams makes business sense. When it comes to innovation, a diverse group of employees representing different backgrounds and bringing different life experiences offers tremendous value. Unless your workforce is representative of your customer and client base, they will struggle to truly understand those needs. Diversity of thought helps us make better decisions.

I believe Barclays’ culture is now completely focused on how we can be at the forefront of innovation. For us, our journey has been about moving away from being ‘just a bank’ to being an organisation that can address wider problems and wider needs in people’s lives. It’s about connecting up all the different aspects of a person’s life and adding value wherever we can.