How cheque imaging is helping small businesses

We visit small businesses in Shropshire and Northumberland to discover how Barclays’ cheque imaging technology is saving time, increasing efficiency – and helping to keep customers happy.

“Bringing in this new way of depositing cheques has been an absolute godsend for us,” says Amanda Mullins, an Account Manager at Battlefield Printing, based in Shrewsbury. “We did stop taking cheques at one point because of the inconvenience of having to get one of our staff to jump in the car and take the cheques to our local Barclays branch to pay them in.”

For the small lithographic and digital printing company, which has been with Barclays since its foundation in Shropshire 27 years ago, there has been a noticeable increase in efficiency since Barclays’ cheque imaging technology was extended to include non-Barclays cheques in November last year. Amanda says: “It took a good 40 minutes out of the day, and sometimes, with a small team, you physically wouldn’t have time to go out to the branch before it closed anyway, so payment was effectively delayed.”

Innovation

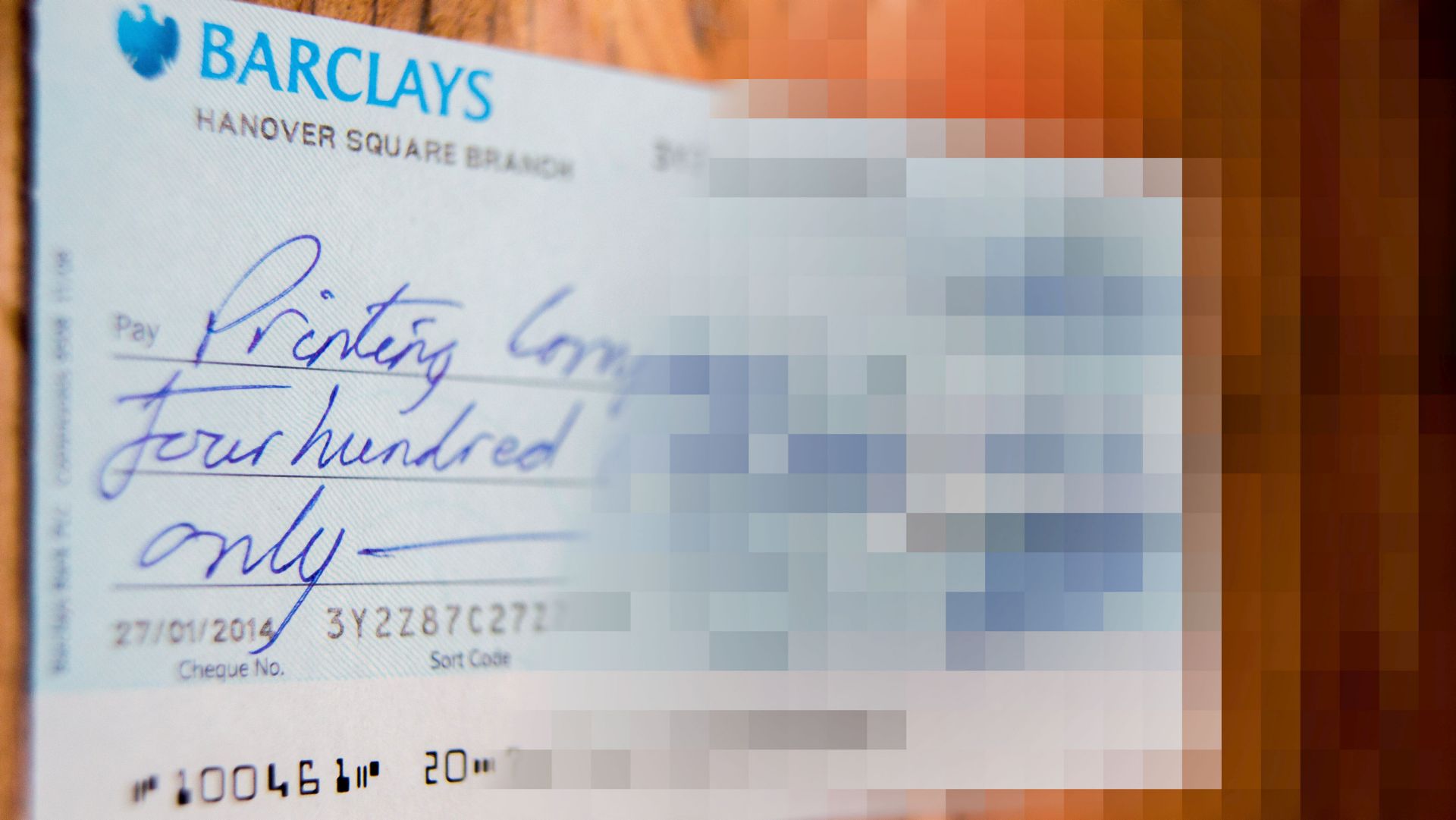

Cheque imaging – new technology developed by Barclays in response to a change in government legislation – allows businesses to ‘scan’ cheques paid in by customers and pay them in to their accounts digitally. The process saves time on the ground between business and branch as well as removing the need for paper cheques to be physically moved around the country.

In May 2014, Barclays introduced a cheque imaging pilot for customers using its mobile banking app, but by the end of 2018 all UK banks and building societies will be on board, meaning the entire, integrated cheque clearing system will speed up. After being deposited, cheques will clear at the end of the next weekday, rather than the six working days the procedure currently takes to complete.

The positive paradox of the innovation is that it also allows businesses to use new technology to help serve their less technologically aware customers. Cheque usage has decreased, but still forms a considerable part of the payments landscape for a company like Battlefield Printing. Amanda says: “We still have a fair number of customers paying by cheque, particularly our more elderly customers, but also others who don’t use online banking.

“The important thing is that we’re not losing out now, and we’re not turning away business because we don’t take cheques. A couple of charities were considering whether to stay with us or not – now we can keep those customers satisfied.”

Northumbrian Gifts

In Ashington, Northumberland, Katrina Wanless, a Director of Northumbrian Gifts, echoes these thoughts: “We still have certain customers who like to pay us by cheque. We’ve been with Barclays since the very beginning of our business, so when the cheque imaging pilot first came out it saved going to the branch, and it saved parking in town. Now, I can literally just take a photograph and it’s in the account.”

Katrina and her husband, Stephen, formed the company in 2004 to supply the major supermarkets with gift hampers of speciality beers from north east England. Since then, the company has diversified into alcohol and soft drink distribution through the region.

Again, the business owner says the benefits of the cheque imaging process are reductions in time and cost: “The time saving and cost implication to banking a cheque does add up. For one of my staff to be out of the business just to go to the bank and park and queue – well, in a small business having one person down makes a real difference.”

Barclays has been piloting the cheque imaging approach with 175,000 mobile banking customers, to help develop the app into a streamlined process. Later this year, Barclays will extend the cheque imaging functionality to all five million customers registered for mobile banking.

Both Battlefield Printing and Northumbrian Gifts are looking forward to this expansion, helping money from all sources reach their accounts faster and more efficiently. “It’s five easy steps,” says Amanda, “and being able to take other cheques now is fantastic.”