Gracechurch Card Funding

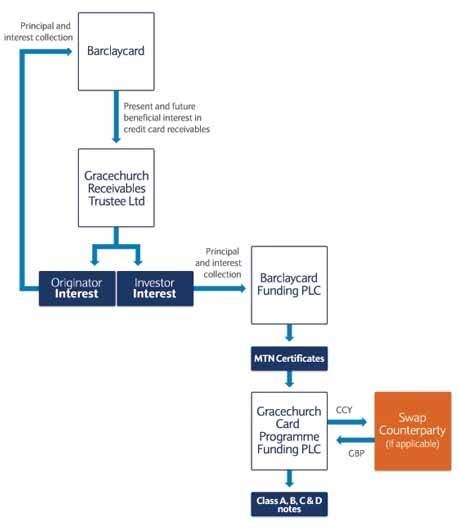

Barclays securitises certain UK credit card receivables through the Gracechurch Card Funding structure

By accessing any of the information below, you expressly agree to the terms and conditions set out in the disclaimer.

Transaction information

Access supplementary transaction information and details of how to request access to key transaction documents:

Use the tabs to choose from: Programme documentation, Final terms, Investor reports, Structure and Amortisation profile.

-

Programme documentation

Document date

Document

Type of offering

22/06/2018

Reg S / Rule 144A

13/11/2013

“SEC Registered” refers to the documents and related offerings of securities that have been registered with the US Securities Exchange Commission (“SEC”) under the Securities Act.

“Reg S” refers to the documents and related offerings of securities under Regulation S, the SEC rules exempting securities offerings outside of the US conducted in accordance with the provisions of Regulation S.

“Reg S / Rule 144A” refers to the documents and related offerings of securities conducted (i) outside of the United States in accordance with Regulation S and (ii) in the United States under Rule 144A only to Qualified Institutional Buyers (as defined in Rule 144A).

Persons in the United States and US persons outside of the United States should not access the Reg S and the Reg S / 144A documents on these webpages.

-

Final terms

Issue Date

ISIN

Currency

Issued Amount (m)

Description

Type of Offering

20/11/2015

XS1321880418

XS1321880509

GBP

GBP

1,500

265

Reg S

Reg S

11/11/2014

XS1133034923

XS1133034253

GBP

GBP

1,600

287

Reg S

Reg S

20/11/2013

XS0992306141

XS0992306224

GBP

GBP

1,400

247

Reg S

Reg S

“SEC Registered” refers to the documents and related offerings of securities that have been registered with the US Securities Exchange Commission (“SEC”) under the Securities Act.

“Reg S” refers to the documents and related offerings of securities under Regulation S, the SEC rules exempting securities offerings outside of the US conducted in accordance with the provisions of Regulation S.

“Reg S / Rule 144A” refers to the documents and related offerings of securities conducted (i) outside of the United States in accordance with Regulation S and (ii) in the United States under Rule 144A only to Qualified Institutional Buyers (as defined in Rule 144A).

Persons in the United States and US persons outside of the United States should not access the Reg S and the Reg S / 144A documents on these webpages.

-

Investor reports

Investor reports may be accessed via the links above. The reports and any notes contained therein (the "Investor Reports") that may be viewed on this page are a summary of certain information derived from internal management accounts. The information in the internal management accounts and the Investor Reports has not been audited. While every effort has been taken to ensure that each Investor Report is accurate and complete as at the date it is issued, no representation can be made that the data contained in the Investor Reports is accurate and complete and no liability is accepted.

The Investor Reports are for information purposes only and are not intended as an offer or invitation with respect to the purchase or sale of securities. Barclays PLC and its affiliates and subsidiaries reserve the right to amend or revise any information contained in the Investor Reports at any time without notification, and the related transaction documents may be amended, supplemented, or otherwise modified, from time to time.

“Barclays” refers to any company in the Barclays PLC group of companies. Not all products or services are available to US residents and or citizens.

-

Structure

![Gracechurch Structure]()

-

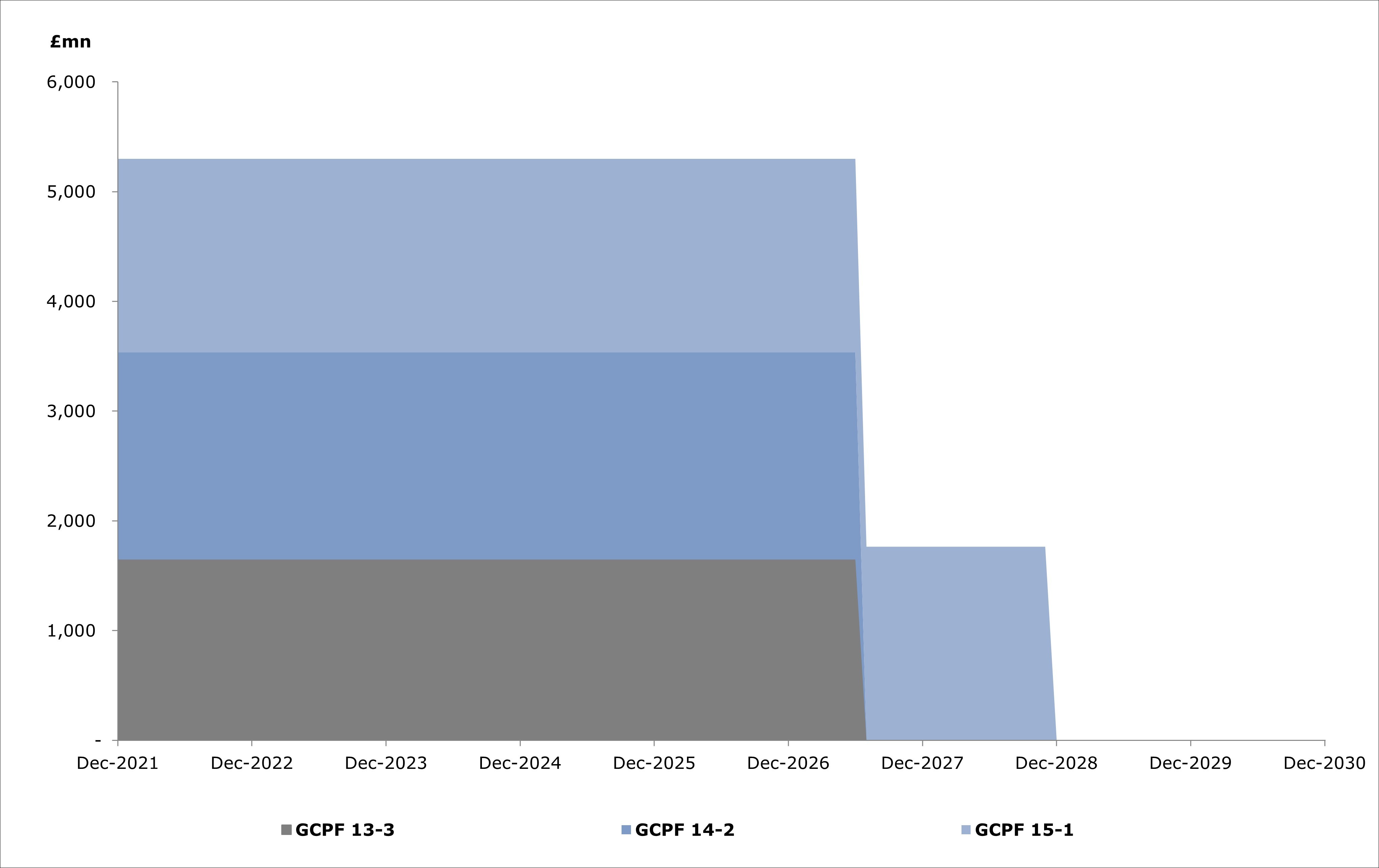

Amortisation profile

![Gracechurch Amorsation Profile]()